Meanwhile, the goals of our previous reviews continue to work out. So, on September 28, the goal was reached at the level of 6800 $, where our regular readers fixed the profit again. After an unsuccessful...

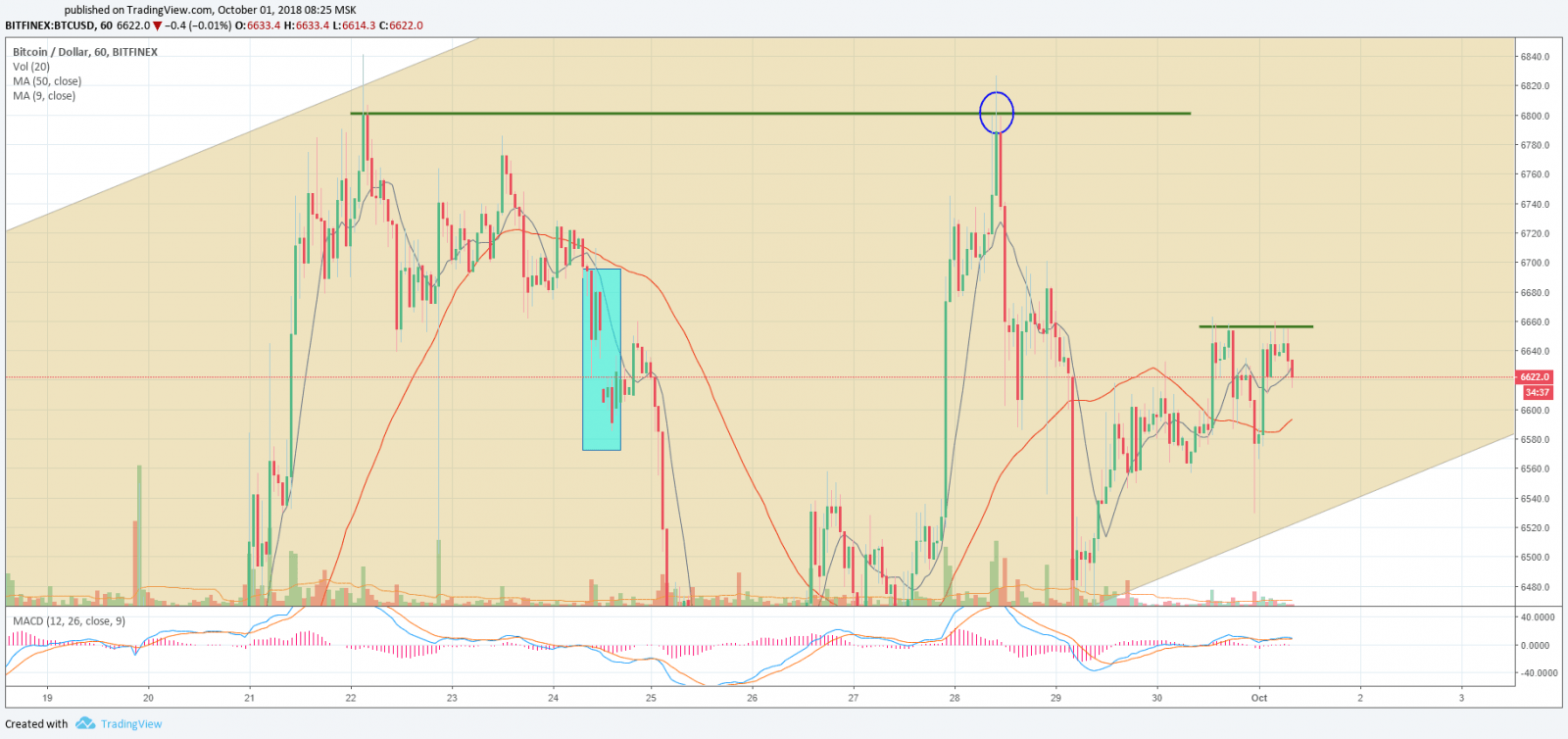

Meanwhile, the goals of our previous reviews continue to work out. So, on September 28, the goal was reached at the level of 6800 $, where our regular readers fixed the profit again.

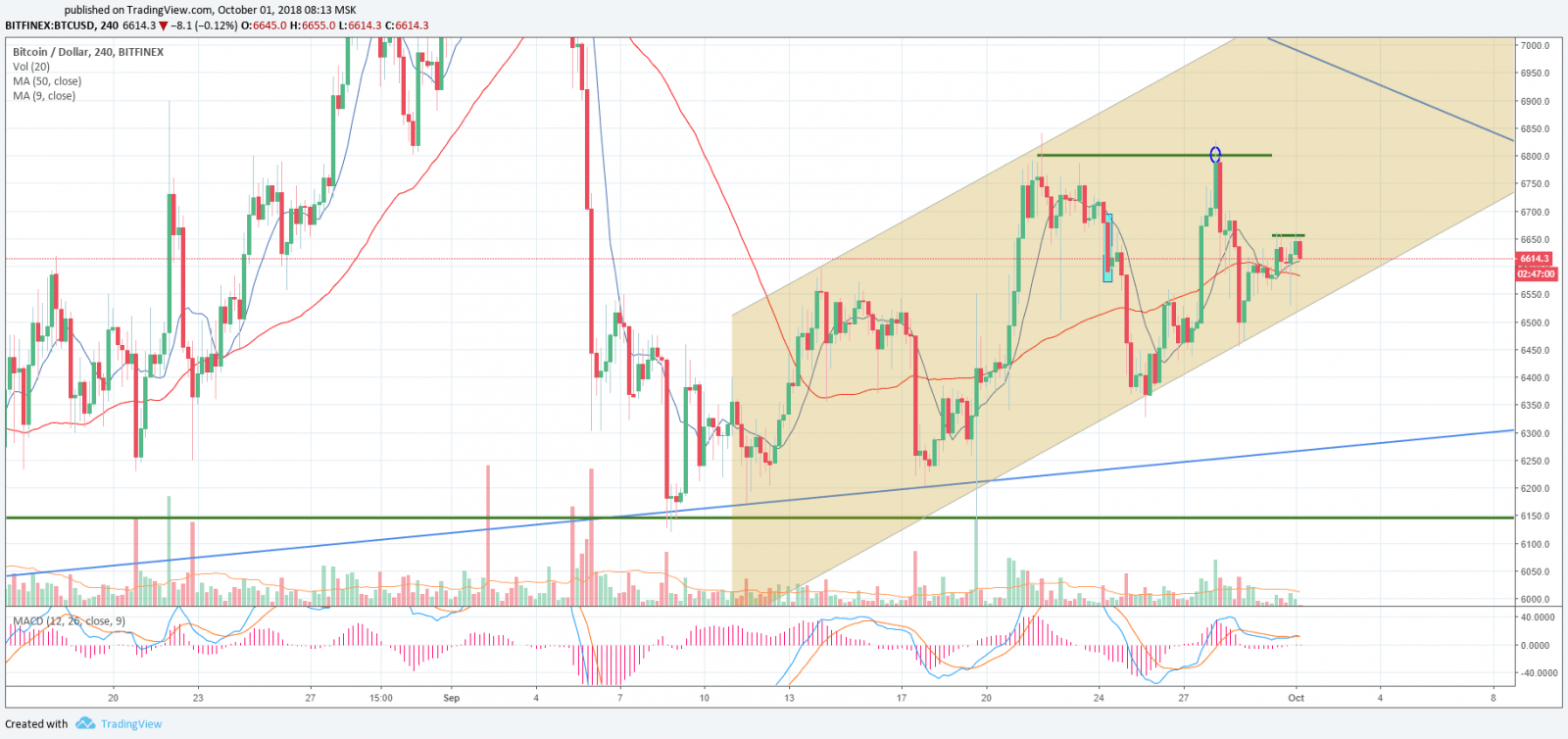

After an unsuccessful attempt to gain a foothold above $ 6,800, the price was corrected by a sharp decline downward. The movement occurred within the channel, and we also warned about it.

At the moment, the BTC / USD pair is trading above the level of 6,600 $ and to continue the upward movement it is necessary to overcome the resistance at the level of $ 6,650.

On the hourly chart, the MACD is almost in the neutral zone, the fast moving average (MA9) is higher than the slow one (MA50) and both are "looking" up, but low trading volumes can’t give momentum to the price either direction yet.

On the 4-hour chart, we see how the price continues to move in the channel near its lower border. The fast moving average (MA9) crossed the slow one (MA50) from the bottom up, but the slow moving average (MA50) tends to go down. This shows, in general, the uncertainty of motion with a more likely downward movement. So far the most logical seems to be the continuation of the flat state for some time.

For the umpteenth time, we notice that the news is no longer able to manipulate the market. Once again, the deferred decision on ETF (this time before 29.12) practically did not affect the course. The new batch of Tether’s stablecoins did not either (about the features of the tokenized dollar you can read in one of our articles). Last week it became known that the balance of Tether USD increased by $ 13 mln. The balance went to Bitfinex. There are sometheories about artificial shocks of the course with the help of Tether USD, but for the past several months we have not seen any changes in the exchange rate after the new tokens release.

Certainly, the most positive news of last week was the information about the imminent launch of the Bakkt crypto-exchange platform (we already wrote earlier that its launching would potentially have a stronger impact on the market than the Bitcoin-ETF). The main product of the platform will be Bitcoin futures, which can be purchased for the US Dollar, the British Pound and the Euro. The development of BAkkt is handled by the operator of the New York Stock Exchange Intercontinental Exchange in conjunction with the Microsoft, Starbucks, BCG. While there are quite a few details about the platform on open access, it is already known that it will not support margin trading, and will also open a fund to protect users from default. Recall that the platform is designed to open the way to cryptomarket for large investors, who do not yet have a reliable tool to enter for it.

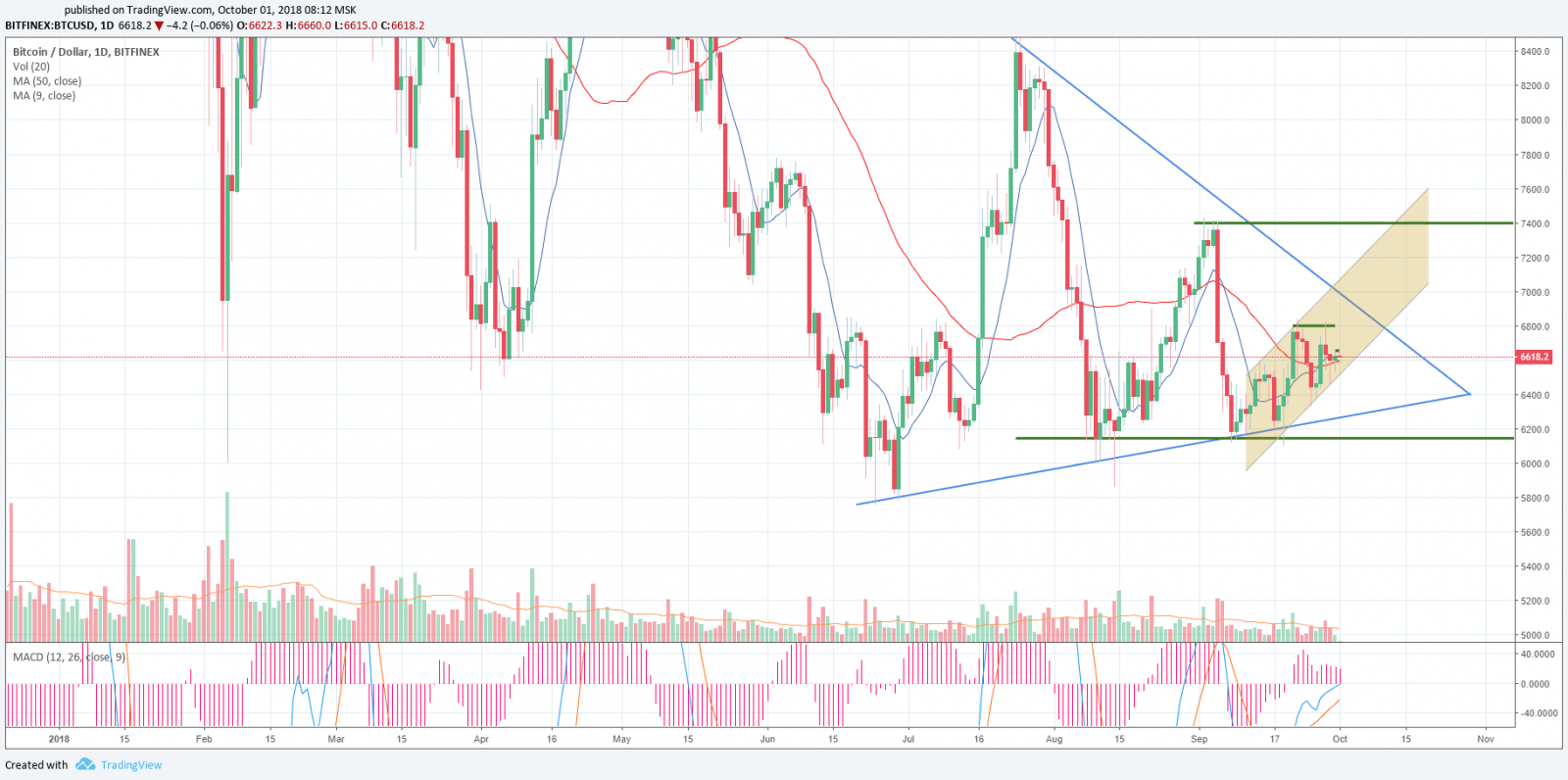

The market capitalization, however, remains unchanged: $ 223,246,775,530. On the daytime timeframe, an interesting situation emerges. On the one hand, the price continues to move in the uplink, on the other - the BTC / USD pair has been trading for a few days in a narrow range in the middle of the triangle's borders. Rapid buyback of the price at a decline and a return to the level of $ 6,600 speaks of the bears’ weakness in the market. MA9 and MA50 are practically on the same level, which again confirms the uncertainty of the further movement.

The first resistance obstacle for the continuation of the upward movement is the level of $ 6,650, and behind it - the already familiar level of $ 6,800.

In the event of a price reduction, the first support will be $ 6,550, followed by $ 6,450.

Share this with your friends!

Be the first to comment

Please log in to comment