Hi Everybody! BITCOIN continues to show that the mood in the market is changing towards recovery. The price is moving in the ascending channel which slightly widened on September 14. Bitcoin is currently...

Hi Everybody!

BITCOIN continues to show that the mood in the market is changing towards recovery. The price is moving in the ascending channel which slightly widened on September 14. Bitcoin is currently trading at $6,500 level.

The goals are the same: to continue moving upwards, the BTC/USD pair has to overcome $6,600 and gain a foothold above that level. The support level is currently at $6,400, where MA50 (Moving Average) point also is. This point is a determining factor: the pair cannot be said to be moving downwards unless it breaks through it and gets a foothold below it. Until then, the forecast predicting Bitcoin growth remains valid.

False channel breakthroughs (marked with the arrows) are better seen on 1 hour timeframe.

Such breakthroughs are attempts to knock down long position holders’ stops. Although these attempts have been unsuccessful, they still cause anxiety among market participants.

We would like to draw your attention to the depth of the impulses – as the pair is moving in the ascending channel, the depth of the channel’s punctures is decreasing. Each new puncture will be at a higher price (the green line on the chart). It is a clear sign that bears do not have enough strength.

The capitalization is $203,142,858,871 and BTC domination is 55.3%.

In our previous review we discussed the news picture in the market. The market is still waiting for a favorable response from institutional investors and major players: it needs “fresh blood”.

The two most important triggers for the near future will be SEC’s decision with respect to a number of cryptocurrency ETFs. The new deadline is the end of September. The other decision crypto enthusiasts are waiting for with sinking hearts is the publication by FATF of its anti-money laundering policy paper.

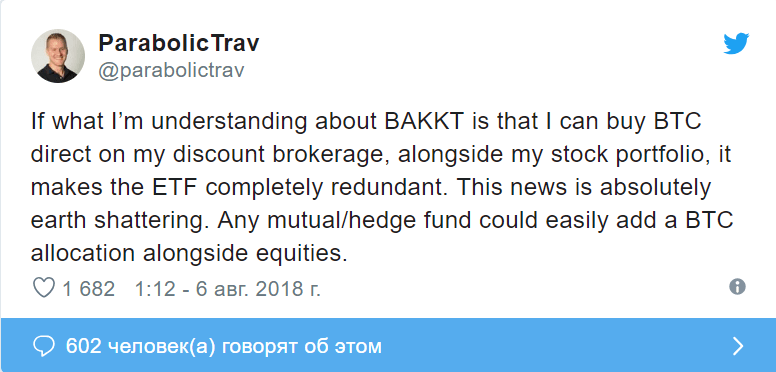

Moreover, some market participants are waiting for the launch of the Bakkt platform from ICE with bitcoin futures deliverable in one day (in future, litecoin ones as well). So far, the launch is scheduled for 1Q 2019. The advantage that Bakkt has is that ICE owns the New York Stock Exchange. If everything goes well, users will be able to buy BTC, LTC and other securities directly by the beginning of 2019.

An inflow of big money into the crypto market can turn into a mixed blessing. It can mean the death of small smart investors who are waiting for unprecedented volatility. The market will be taken over by professionals who made big money on the crisis of 2008 and other years, as well as on dot-coms. They will be selling, not buying at the times of growth.

Our recommendations for today (17.09) are as follows: if you have open long positions up to $6,100- $6,300, keep them open until the goals have been met (the first goal - $6,600) and proceed to $7,400.

We wouldn’t recommend anybody else to enter the market at the moment, as the trend is not yet clear. Don’t miss our next report!

Share this with your friends!

Be the first to comment

Please log in to comment