Types of crypto arbitrage Cryptocurrency arbitration mechanism — 2018 Arbitrage example Where to monitor the price differences for crypto arbitrage? The advantages and risks of cryptocurrency...

- Types of crypto arbitrage

- Cryptocurrency arbitration mechanism — 2018

- Arbitrage example

- Where to monitor the price differences for crypto arbitrage?

- The advantages and risks of cryptocurrency arbitrage

While the crypto market is at stabilization stage accompanied by its rapid development, the prices for the same cryptocurrencies vary quite a bit from exchange to exchange.

The price difference is attributable to the ratio between the sellers and the buyers on various exchanges leading enterprising market participants to the idea of cryptocurrency arbitrage, in other words, the possibility of making a profit from changes in currency rates. Such a wide price spread also results from the difference in the goals pursued by the buyers: someone may need to buy BTC to make an urgent payment, and therefore, he is willing to buy tokens at current prices, while another buyer is seeking long-term investment, so he’ll wait for a better price.

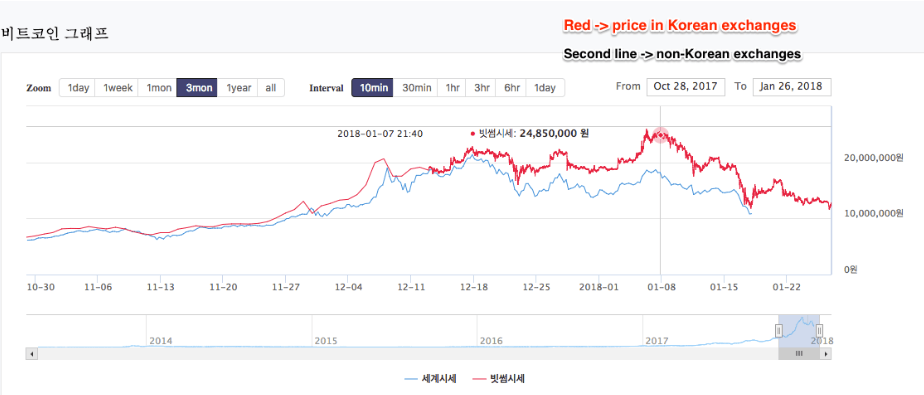

Surely, some of you must have heard of KimChi Premium. The word describes the phenomenon of BTC price difference between Asia and the West (probably, the most profitable arbitrage in the cryptocurrencies’ history). KimChi Premium was first mentioned in December 2017 when the spread between the prices of Bitcoin reached 30% rising to the record-high 50% on 8 January 2018. The red curve reflects the price movement on [South] Korea’s local exchanges.

At the time, many [South] Koreans bought cryptocurrencies in Thailand to then sell them on the local exchanges. One can only rarely expect to get such good chances on the market, of course, but there are always arbitrage opportunities — a quick glance at the bitcoin price difference in various exchanges on Coinmarketcap will support that. We will discuss it later on, and let’s now have a closer look at the theory.

Arbitrage is not an idea unique to cryptocurrency — it comes from the classic financial markets. On Forex, for example, one can often do arbitrage when there is a spread between the prices of an individual currency across various markets. As far as Forex and other conventional markets go, arbitrage is not available for small-amount traders as the game is worth the candle only when big amounts are involved. That’s why it is mostly major investment funds and financial insititutions that are involved in arbitrage. In addition, special robots that compute arbitrage-worthy currencies are not available to rank-and-file players.

Entry to the cryptocurrency arbitrage market is relatively simple and accessible. In this article, we will discuss the arbitrage process, give some examples and examine risks.

Types of cryptocurrency arbitrage

Traders involved in arbitrage use a number of strategies, of which three most widely used strategies can be identified:

- Inter-exchange arbitrage — This article will focus particularly on this way of making profit. It is quite easy to make a profit this way, if you have a small deposit. Inter-exchange arbitrage implies the purchase of cryptocurrency on one exchange and its subsequent sale on another one. The difference between the purchase and sale prices will be you profit from the arbitrage.

- Intra-exchange arbitrage - Intra-exchange arbitrage is a less common method of making profit through arbitrage. It involves the use of several pairs. For example, you can purchase BTC for ETH, then sell BTC for LTC and exchange LTC for ETH. Such pairs are not easy to find, but this option is more profitable, as there are no inter-exchange commission fees involved.

- Index futures arbitrage — This option has became available only recently with some exchanges launching BTC futures contracts. Insightful traders find a way of getting information on futures contract rates and profit from incorrect assessment of relevant assets.

What is crypto arbitrage?

Cryptocurrency arbitrage is a type of trading where a trader buys coins on one exchange at a low rate and sells them on another exchange at a higher one.

Cryptocurrency arbitrage seems very simple, in theory — buy cheap and sell high. In arbitrage you buy a cryptocurrency in one place and sell it at another, so you speculate, in fact. This type of making a profit on cryptocurrencies is relatively safe. However, there is always a risk that the asset price may dramatically change in-reselling.

So, how to make a profit on cryptocurrencies arbitrage in 2018?

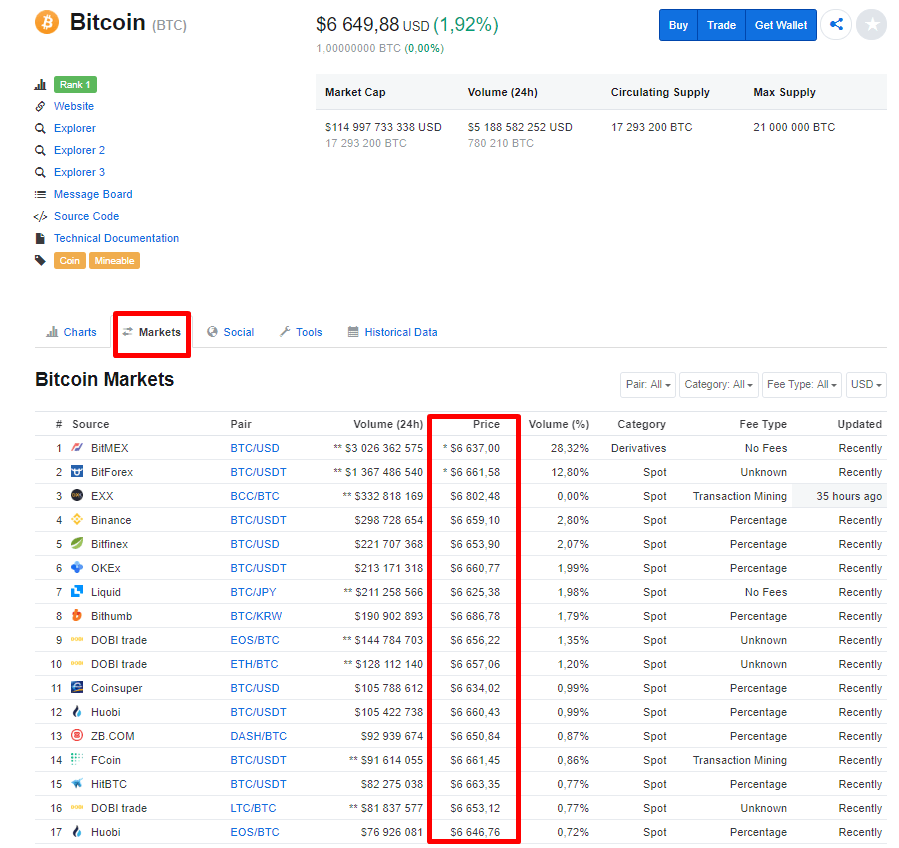

- First, we identify a cryptocurrency that’s cheaper on Exchange A than on Exchange B. Coinmarketcap site will help us to do it — we just open the Cryptocurrency page, go to the Markets tab and the Exchanges and Prices List will open for us to examine.

- We now have to select two exchanges with the biggest price spread between BTC prices. We go to these exchanges and open accounts if we haven’t done it earlier.

- However, before you open an account, make sure to check the fees the exchange charges and calculate your profit taking into account all charges the exchange will deduct. Please note that the money you invest in a transaction should exceed the exchange fees by a factor of three, as a minimum. And if the game is worth the candle — then go forward,

Before you decide to do arbitrage, we would recommend you to review the market situation. A flat market is the best time to carry out transactions of this type. It would be a good idea to read the news carefully — the market may be expecting a major event and the flat may by just a lull before a storm.

The bottom line is that cryptocurrency arbitrage is a valid choice when the following conditions are met:

- Your budget is over $100.00

- The transaction fee is lower than you projected profit.

- Cryptocurrency arbitrage happens when the trading activity is low.

- The price differential is at least 2%.

Arbitrage strategy

We will now examine the most optimal cryptocurrency arbitrage strategy which can be implemented even with a small deposit in your hands.

If you do not have special tools to monitor cryptocurrency price differences against BTC, you can do it in the Markets section on Coinmarketcap.

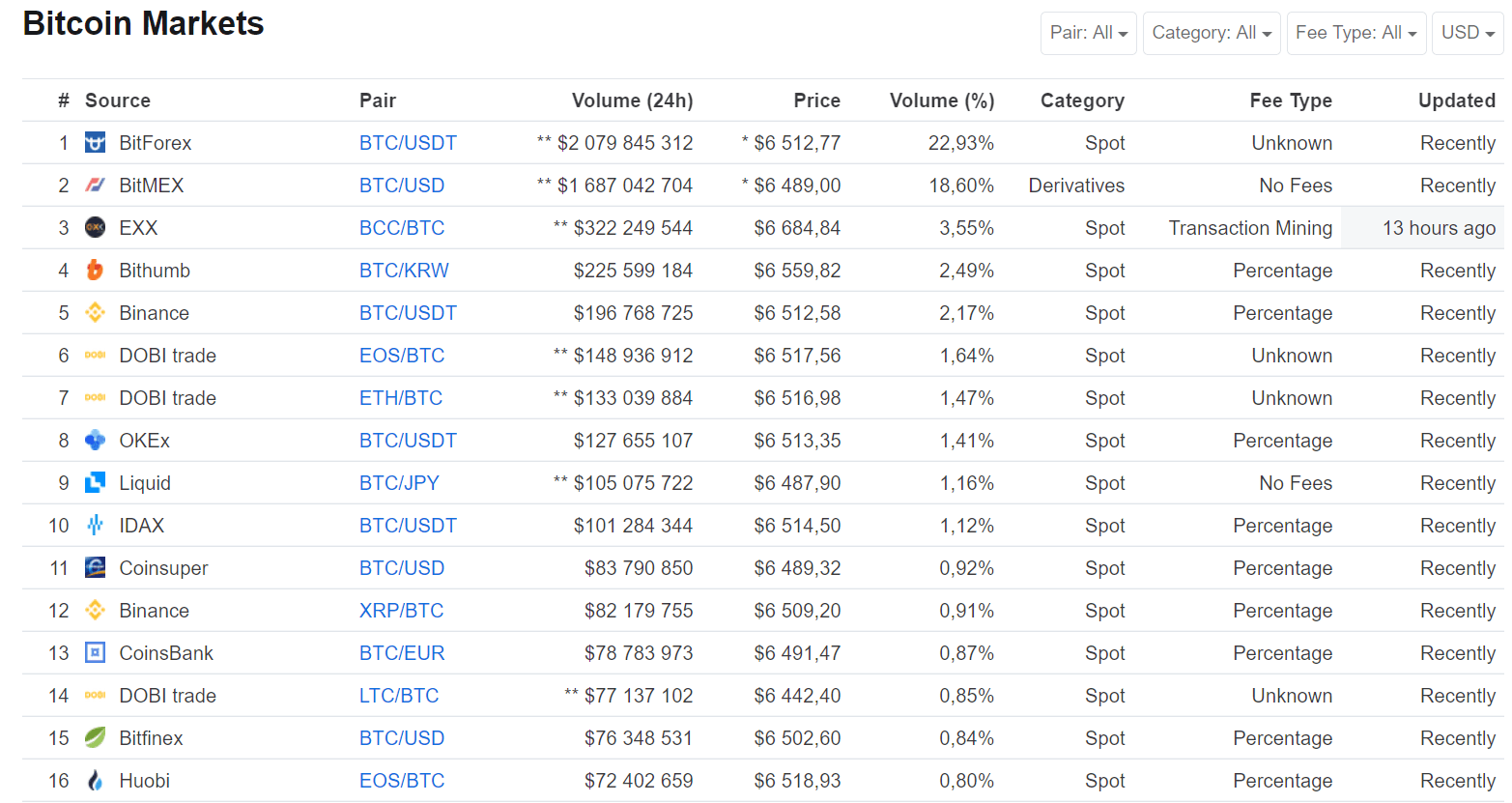

We see that today, on 27.09.2108 an arbitrage trader can buy BTC on DOBI for $6,442 and sell on EXX for $6,684. The spread is about 3.5% so this may be, potentially, a profitable transaction.

Where to monitor the price differences for cryptocurrency arbitrage?

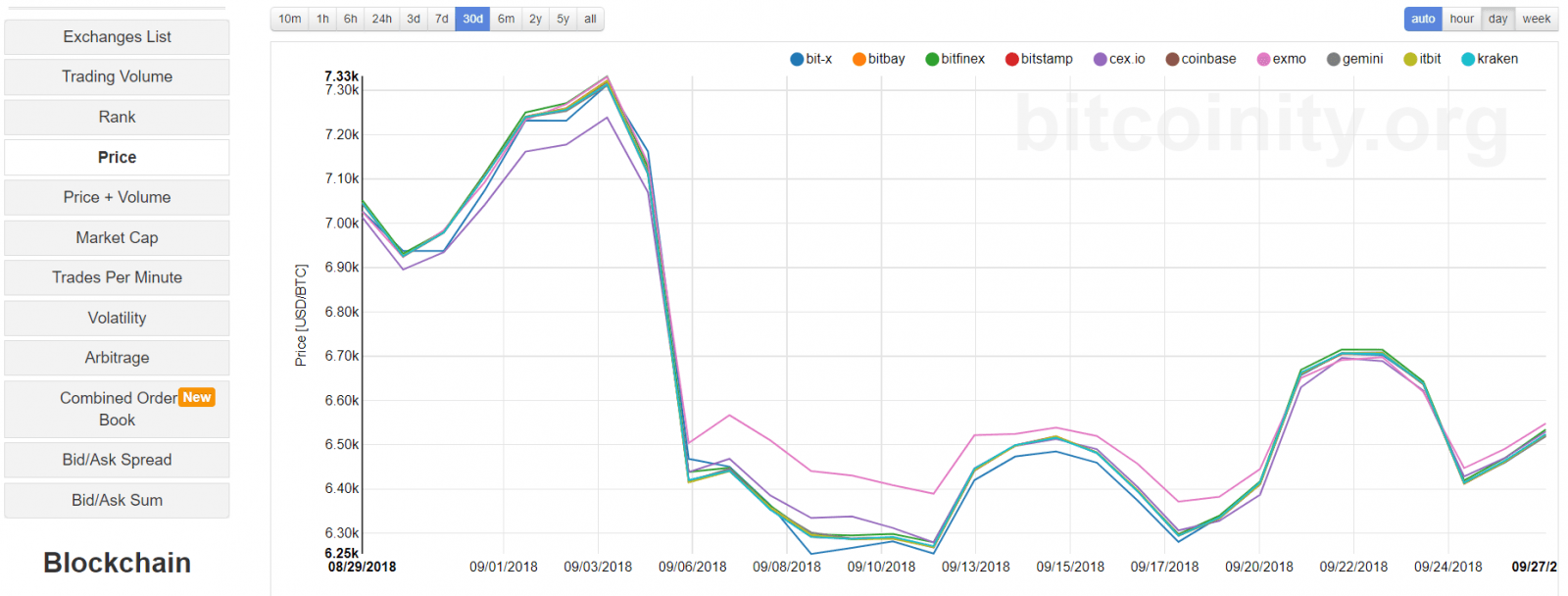

In addition to Coinmarketcap, you can monitor cryptocurrency rates in real time on Bitcoinity service. You can clearly see the BTC price differences across exchanges.

Those who prefer smart phones can use the tools available on zTrader, TabTrader apps that connect to information from a number of exchanges.

The advantages and risks of cryptocurrency arbitrage

At first glance, cryptocurrency arbitrage is all about advantages:

- High volatility. The market remains unstable and, as every trader knows, where there is volatility, there is a high potential for making a profit.

- A large array of crypto exchanges. At the moment of writing, 217 crypto exchanges were added to Coinmarketcap. To get registered on most of them you just need a login and a postal address.

- Market immaturity. Despite all the hype, experts consider the cryptocurrency market an emerging one. Thus, at the moment of writing, the market cap was $220bln, while capitalisation of the equity markets was estimated at nearly $80 trillion. Arbitrage traders can eventually benefit from relatively low trader numbers and low competition, compared with the conventional markets.

- Opportunity to make quick profits. Cryptocurrency market enables to carry out arbitrage transactions within a narrow time frame and thus trade in assets much quicker than in the conventional markets.

However, not everything in the garden is rosy. Where there is a chance to make money with no effort, there is a high risk to lose big time. Below are some stumbling blocks on the way to easy profits:

- KYC — some exchanges have in place Know Your Customer process or mandatory identification of users. Document verification exchanges do usually takes about a week and, given the market volatility, a prospective transaction is likely to become irrelevant.

- Exchange hacking risk. It is always more dangerous to keep cryptocurrencies in hot than cold wallets. However, you need to keep money on an exchange account in order to do an arbitrage transaction;

- Need to trade in big volumes. We have already mentioned that you need to trade in big volumes, at least three-fold higher than the exchange fees in order to generate tangible income;

- High volatility.The fact that in our view facilitates arbitrage may become a hurdle if the asset price plunges during a transaction and the trader will not make a profit.

- Long transaction time. Blockchain is positioned as a solution to the slow bank transactions; however, cryptocurrency transfers between exchanges sometimes take several hours. And against the backdrop of the already-mentioned volatility, the delay may deprive the trader of his profit.

- Increasing competition. As more people learn about arbitrage opportunities, making profits off small amounts will become increasingly challenging.

If you haven’t got scared after reading about all disadvantages of the cryptocurrency arbitrage, we would like to offer you some tips:

- Monitor the market: Monitor forums and telegram channels that publish news on listings on new exchanges. The asset price is often greatly undervalued at the time of listing and this it an ideal time for arbitrage.

- Deal with reputable exchanges only: read reviews and comments before sending your money to an exchange.

- Do not keep all your money on one exchange. Spread it across several platforms. Ideally, use both cold and hot methods to store cryptocurrencies.

- Diversify risks — do not put your entire deposit into arbitrage transactions.

Share this with your friends!

Be the first to comment

Please log in to comment