After the sharp BTC pump associated with the USDT fall, the expected depreciation occurred. Meanwhile, the USDT is actively engaged in restoring its reputation: Director of Legal Compliance Tether Ltd....

After the sharp BTC pump associated with the USDT fall, the expected depreciation occurred. Meanwhile, the USDT is actively engaged in restoring its reputation: Director of Legal Compliance Tether Ltd. Leonardo Riel stated yesterday that all the USDT tokens are provided with fiat reserves. We reviewed the situation with Tether in detail in our previous review. At the time of writing, Tether is trading at $ 0.97. The BTC growth «due to the decrease» in USDT is quite a comical situation in the market, but we do predict the price based on technical analysis knowledge, and they do not let us down. If you are trading according to our recommendations, you have already received a profit more than once. Well, and now according to tradition — let’s have a look at the charts.

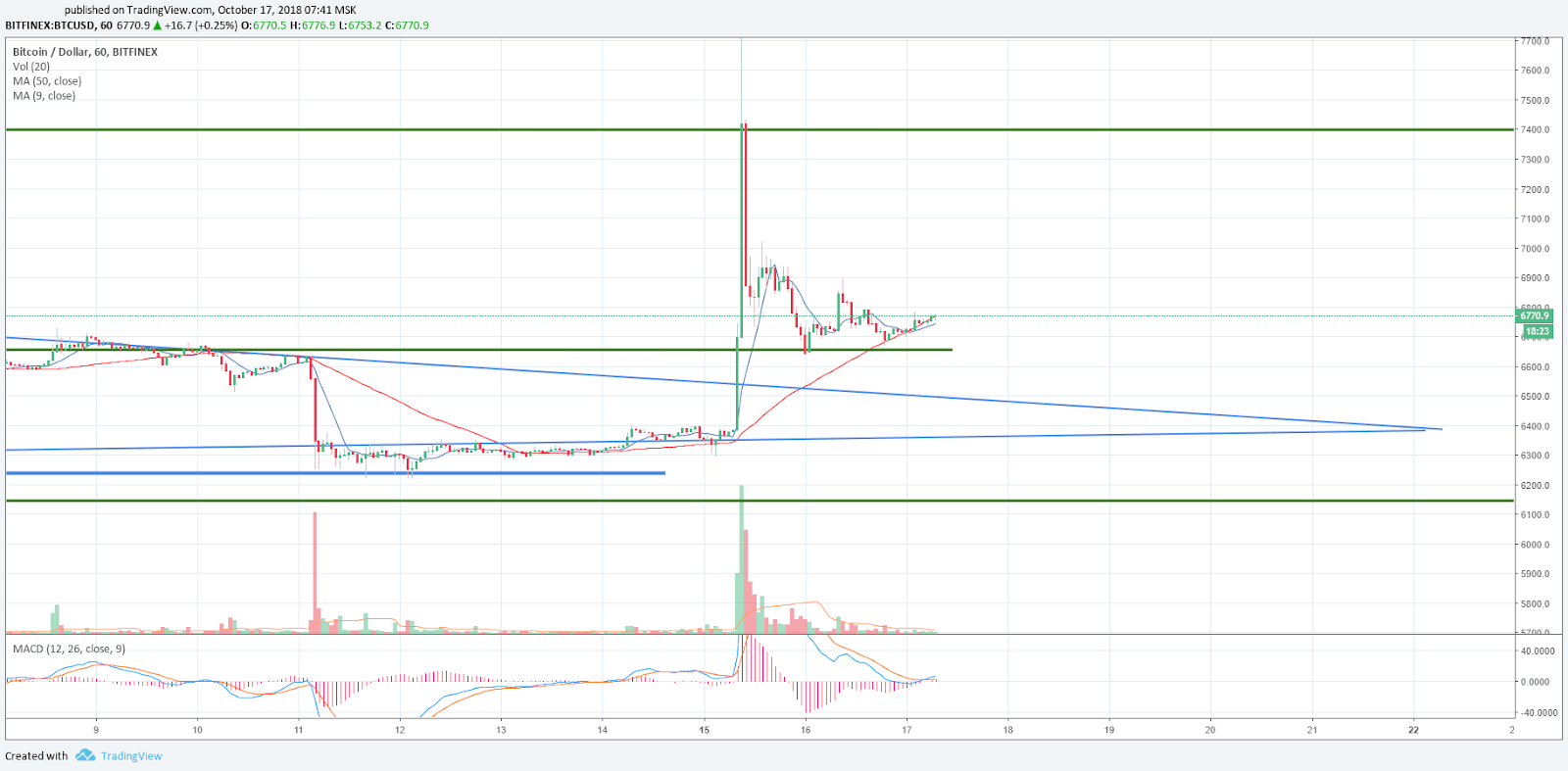

Let’s start small-time: 1-hour time

We unloaded the schedule as much as possible, leaving only the key levels. You can clearly see how the price moves along the line (see chart). So, the price went up from the triangle, and at the same time, many levels of resistance were broken through. Now the price is moving in the side channel in the range of $ 6900–6650. The slow sliding average MA50 is below the price, thereby providing support, and tends steadily upwards. The fast MA9 is still lower than the MA50, but it is also striving upwards and, possibly, soon will cross it. The MACD indicator is in the neutral area with a transition to the trading area. All this suggests a further upward movement.

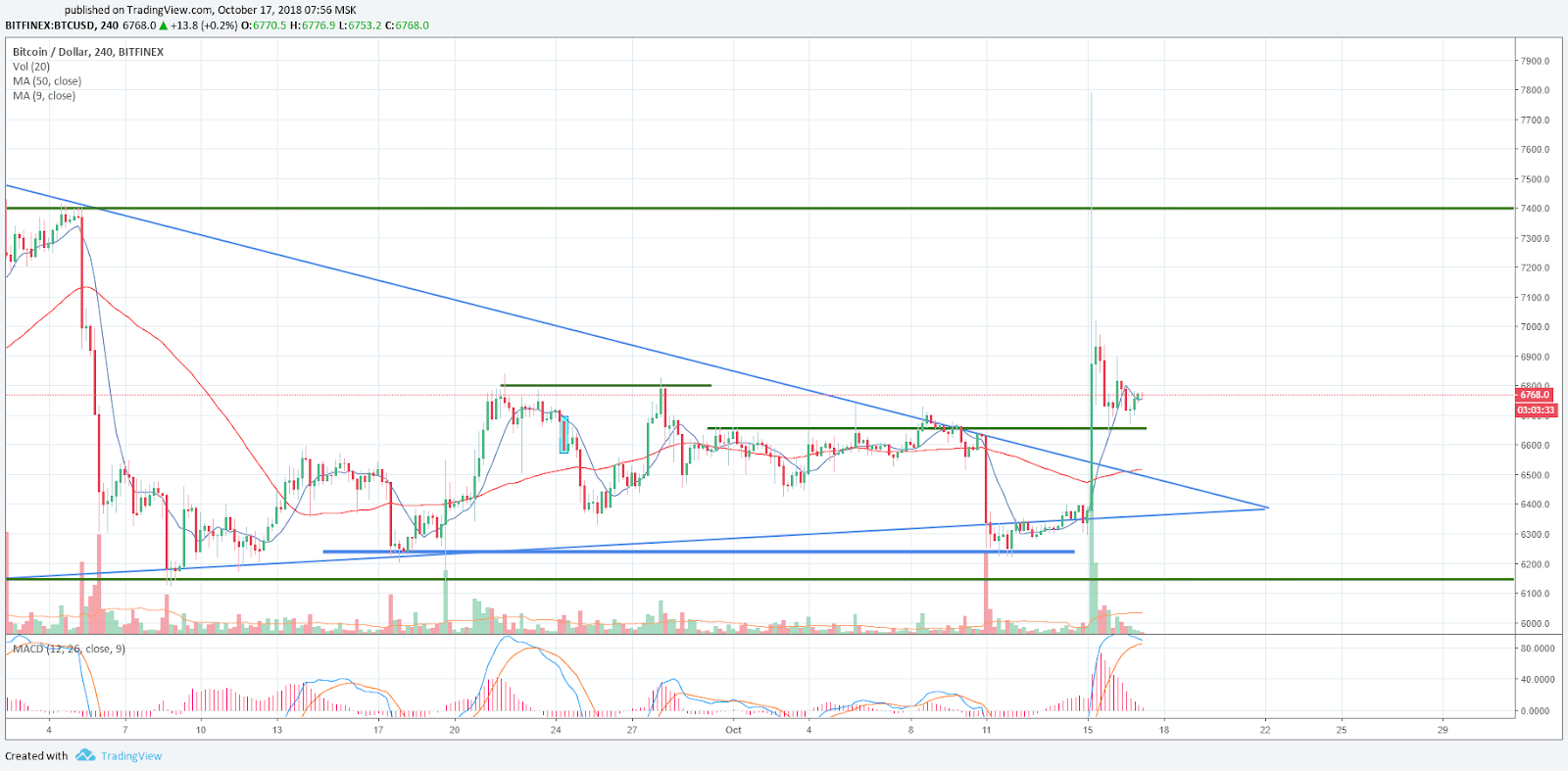

On the 4-hour timeframe, the fast MA9 is turning up, the slow MA50 under the price also indicates an upward movement. MACD indicator is in the trading area.

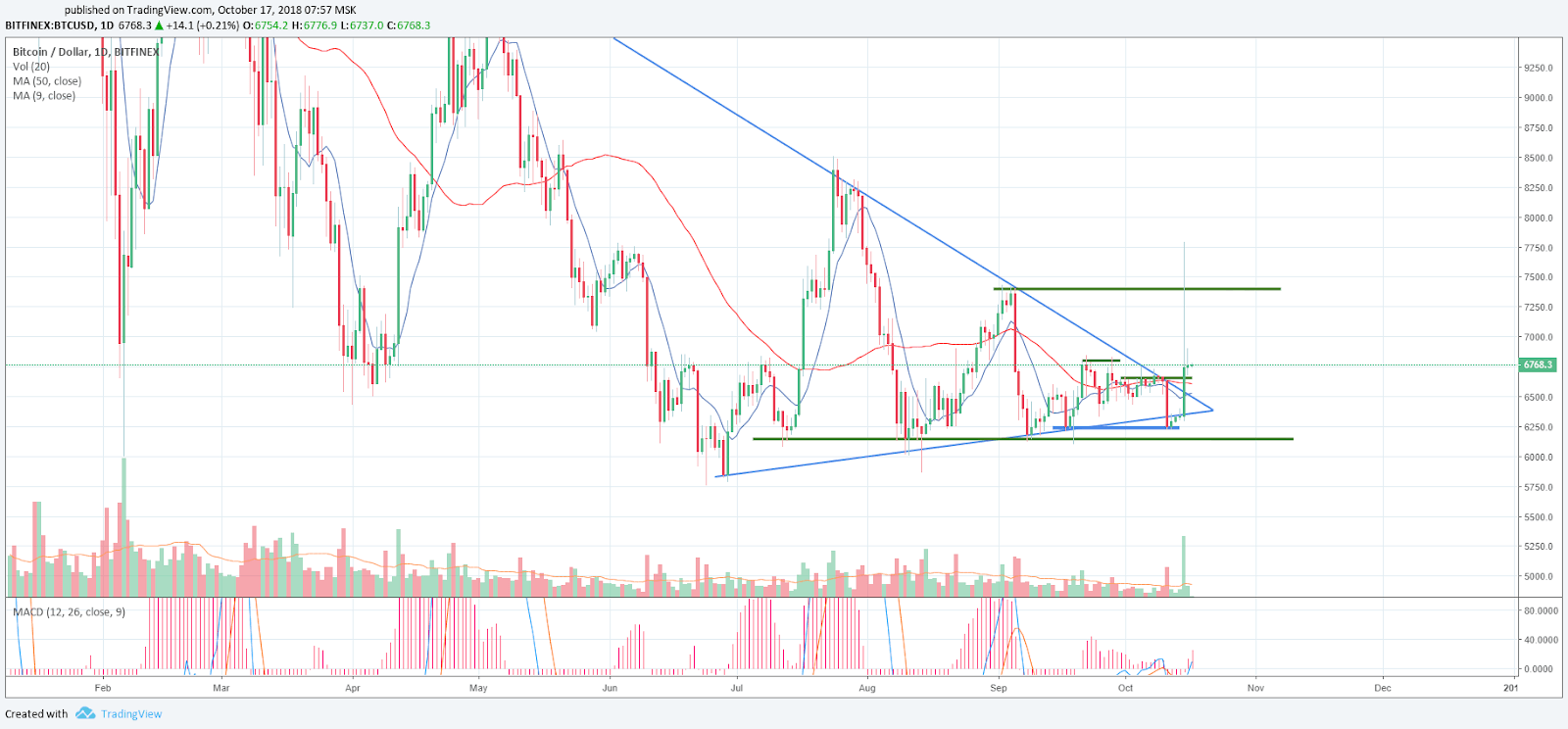

Moreover, on the daily timeframe, important levels of support and resistance are clearly visible. The MACD indicator moves from the neutral area to the shopping area. Slow MA50 under the price, fast MA9 turns up.

At the moment, everything is about the continuation of the upward movement. However, it is likely that for some time we will observe flat at current levels.

What is essential now for the resumption of the upward movement? It is critical to consolidate above $ 6,800 — this will open the way to the next strong level of $ 7,400. The immediate support is the range of $ 6,700–6,650. For those who are willing to take risks, we can recommend opening deals to buy support levels and below them. The stop is at the average level.

Having read our previous recommendations, you can understand the basics of behaviour in the cryptocurrency market. Also, most importantly, you can easily calculate the profit according to our recommendations: opened buy orders from levels $ 6,100 and $ 7,400 closed with a profit of more than $ 1,000 per 1 BTC. At the same time, our strategy is relatively risk-free — we do not use leverage.

We wish you all a profit! Until Friday!

Share this with your friends!

Be the first to comment

Please log in to comment