Hello. How did your weekend go? Let’s have a look at the charts and sum up the results of the past week and month in the cryptocurrencies market. A one-hour chart In the one-hour timeframe the price trades...

Hello. How did your weekend go? Let’s have a look at the charts and sum up the results of the past week and month in the cryptocurrencies market.

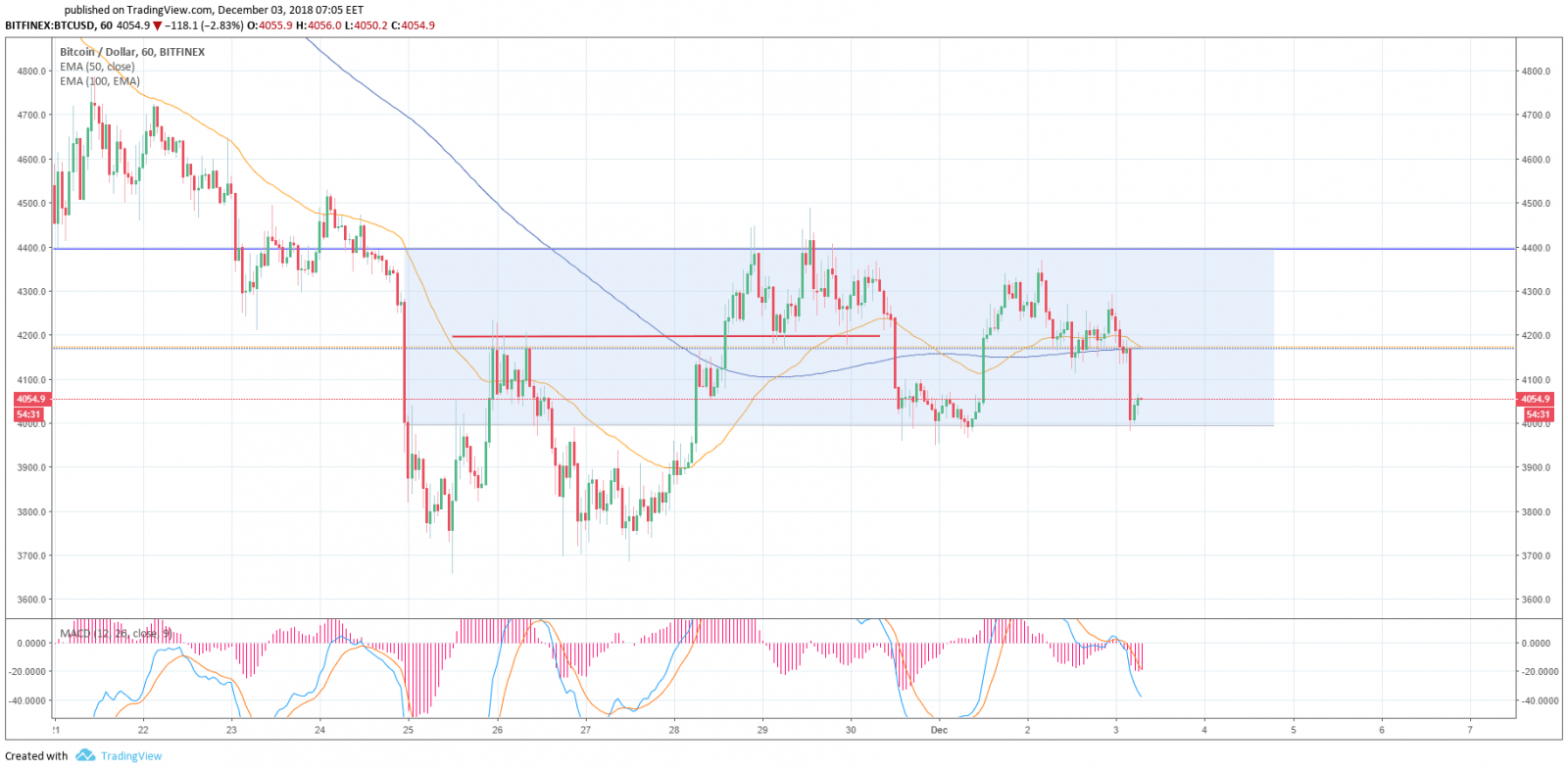

A one-hour chart

In the one-hour timeframe the price trades in the sideways channel. The $4,400 acts as the resistance level and the upper margin of the channel; the area near $4,000 provides support and acts as the channel’s lower margin.

Moving averages are above the price on the chart. EMA50 is trying to cross EMA 100 top-down — a negative signal for the bulls and a positive one for the bears. The MACD indicator is also in the sell zone.

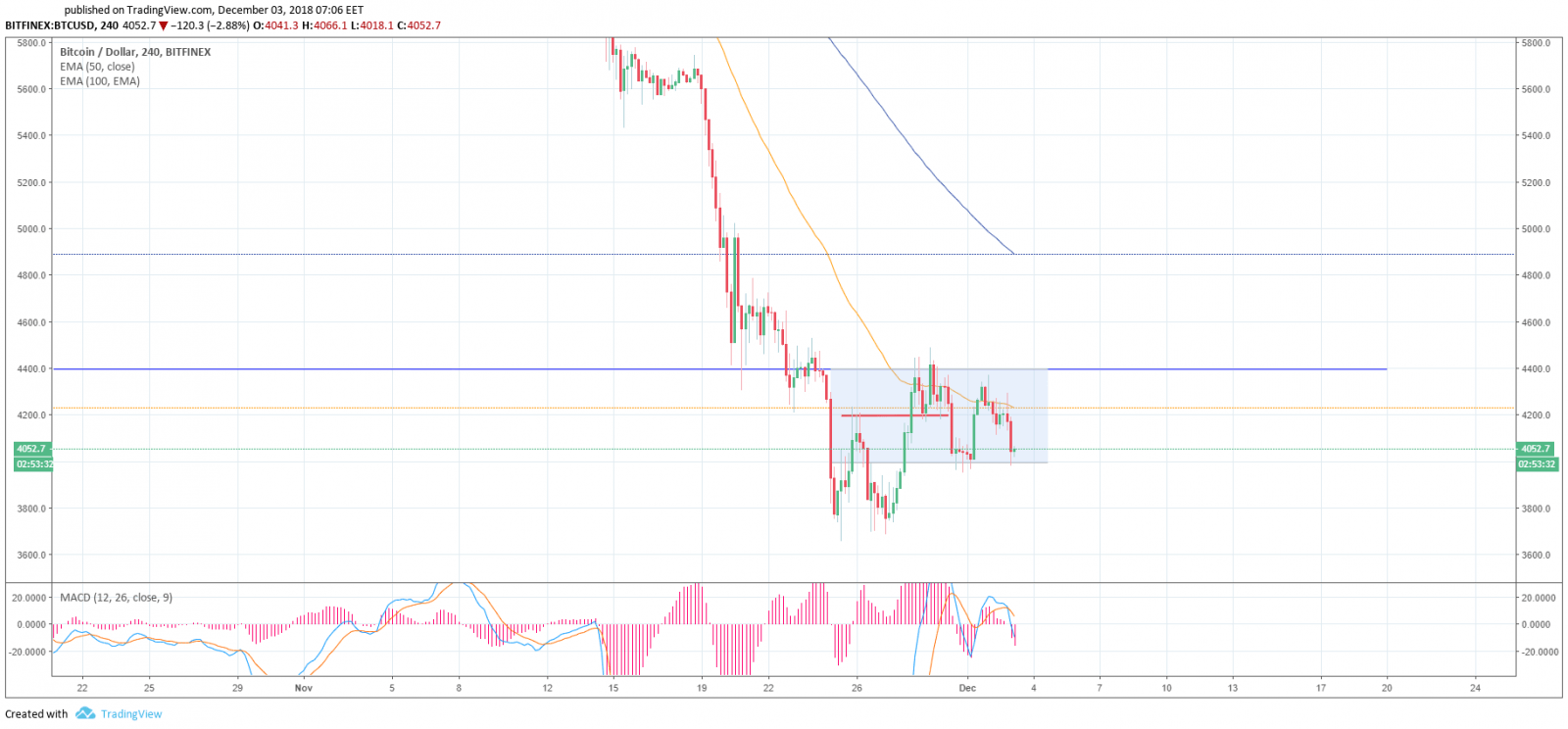

The 4-hour chart

The situation is similar to that on one-hour chart. The price trades between $4,400 and $4,000. Moving averages are above the price on the chart. EMA 50 near the $4,220 level acts as the local resistance. The MACD indicator is in the sell zone.

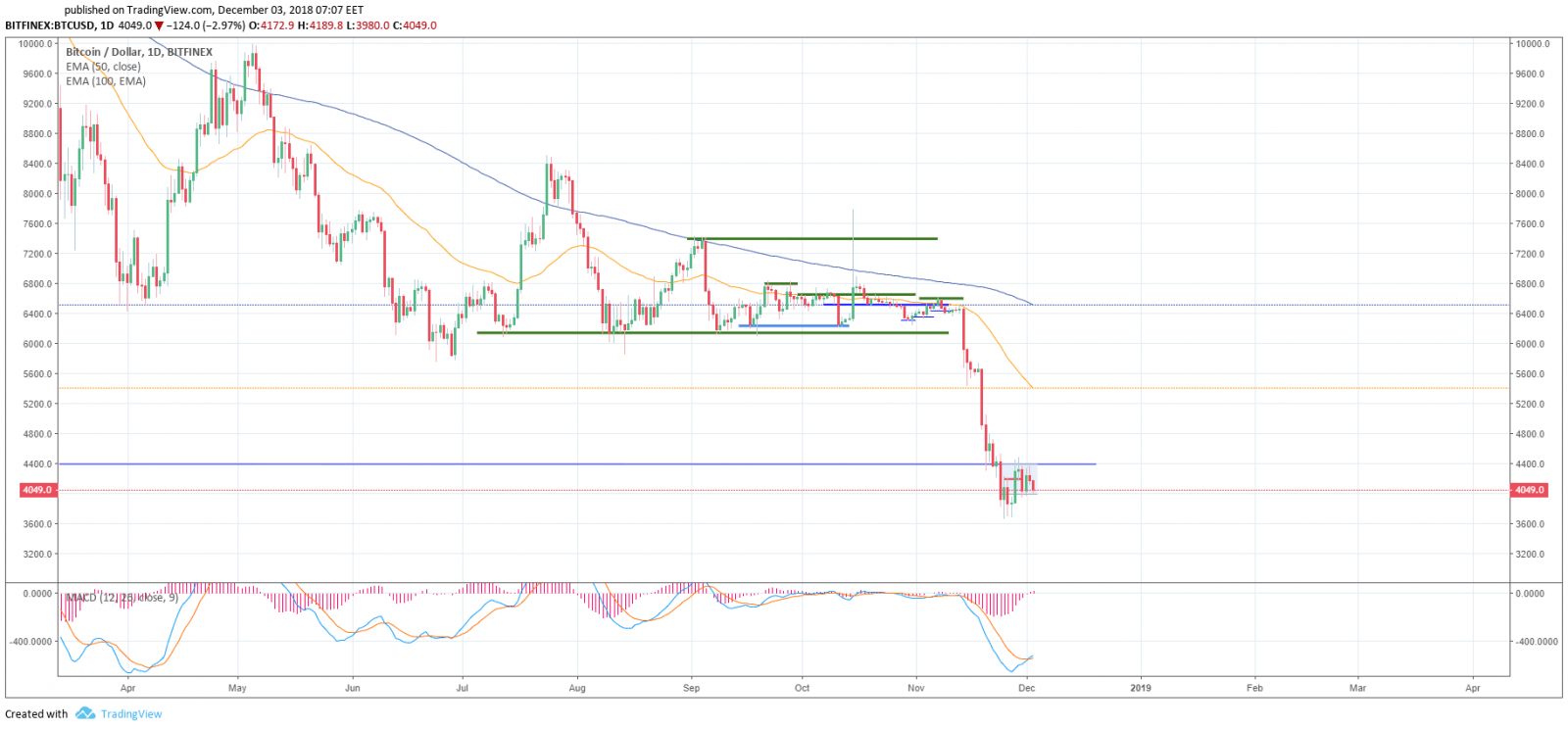

Nothing has changed in the daily timeframe since our previous review. Moving averages are above the price on the chart and going down. The MACD indicator is in the sell zone.

Summary: the week and the month in the cryptomarket.

November became the worst month over the past 7 years for the cryptomarket as it saw the cryptocurrency sink by 37%. Over the past few weeks, the main cryptocurrency moved between two psychological points — $4,000 and $4,500. Many experts have already expressed an opinion, that bitcoin can hit the bottom at the $3,000 level.

As a result, all cryptocurrencies in the top Coinmarketcap started to lose value over the last week. Only Bitcoin Cash — Bitcoin SV fork demonstrated positive price movements.

We can see sad trends among the miners as well: Shixing Mao, the F2Pool founder, notes that due to the sinking market between 600, 000 and 800, 000 bitcoin miners have got disconnected since mid-November.

He believes that cryptocurrency mining on such devices as Antminer T9+ from Bitmain or AvalonMiner 741 from Canaan Creative is currently loss-making. In the last week of November, the number of ads to sell mining equipment went up 24%, according to the Yula advertising service.

What is the outcome of the G20 summit for the cryptocurrency market?

The G20 Summit in Argentina resulted in signing of the declaration by the heads of state that, among other, noted the need for cryptocurrency regulation and creating a unified system of digital assets taxation. The document states that regulation will be in line with the standards of the Financial Action Task Force (FATF).

Declaración de Líderes del #G20Argentina (inglés)

-#G20 Leaders’ Declaration https://t.co/UHzrbEL9jv#G20Summit2018— G20 Argentina 🇦🇷 (@g20org) December 1, 2018

We spent the week at the same levels and formed a number of key ones: for the ascending movement it became $4, 4000 and there were several attempts to test it last week.

They buy very quickly when the price drops to $4,000 — $3950. We can assume that there is no hurry to lower the price to the yearly minimum ($3,657). Though there are good volumes to buy in the $3,000 −3,500 area.

This week, we will probably continue trading in the sideways channel.

We wish you all an excellent week!

Share this with your friends!

Be the first to comment

Please log in to comment