Hello! The end of the month is getting closer, and the market continues to squeeze out impatient players. All the last week, the Bitcoin has been trading in a narrow side channel, and BTC / USD pair updated...

Hello! The end of the month is getting closer, and the market continues to squeeze out impatient players.

All the last week, the Bitcoin has been trading in a narrow side channel, and BTC / USD pair updated the last week lows (25.10), but with no signs of decline. Therefore, we conclude that, most likely, the pair does not have a goal to decline for the minimum. So let’s look at the charts.

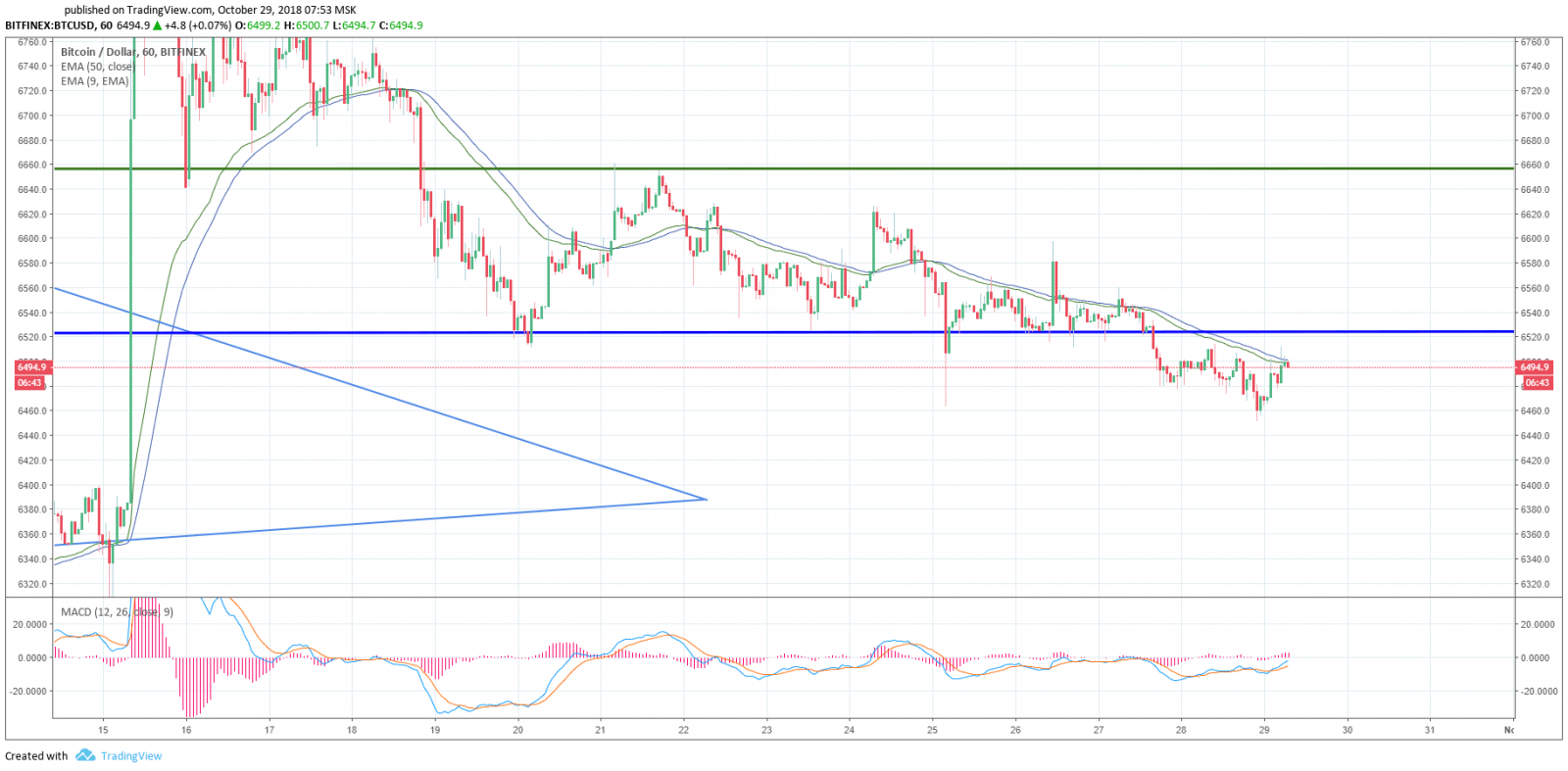

Hourly chart

After touching the level of $ 6,451 (which is a little below the level we mentioned about in conclusion of the latest review), the Bitcoin is trading at the level of $ 6,500. The EMA9 and EMA50 are located above the price and at the time of the review, writing is aligned to the neutral position. MACD shifts from the trade area to the buy area.

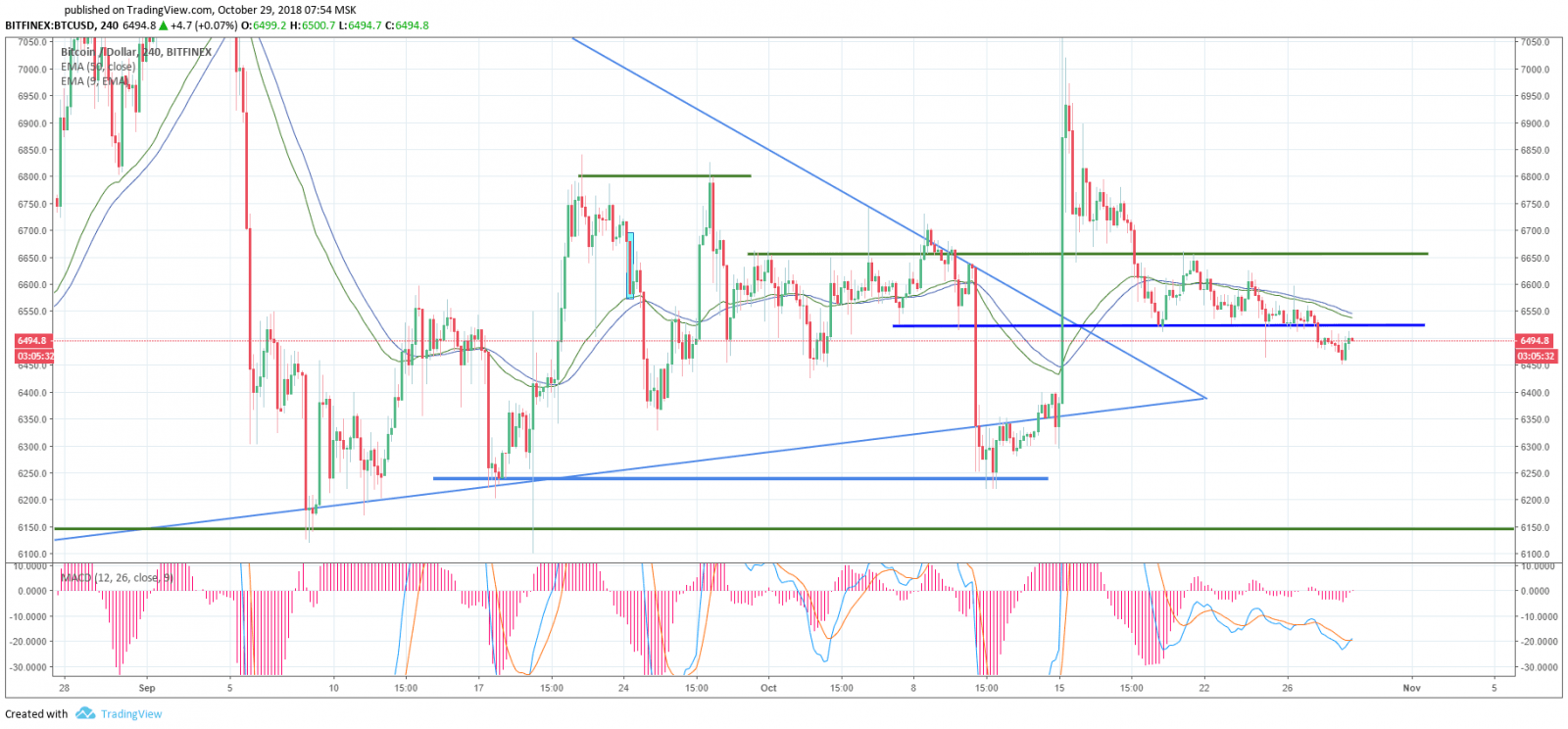

4 hours chart

At the moment, the Bitcoin is trading at levels where it has already been trading at the end of September (25-26) and at the beginning of October (02), being in the support area. Indicators show a continuation of the decline, the volumes remain low — as well as volatility.

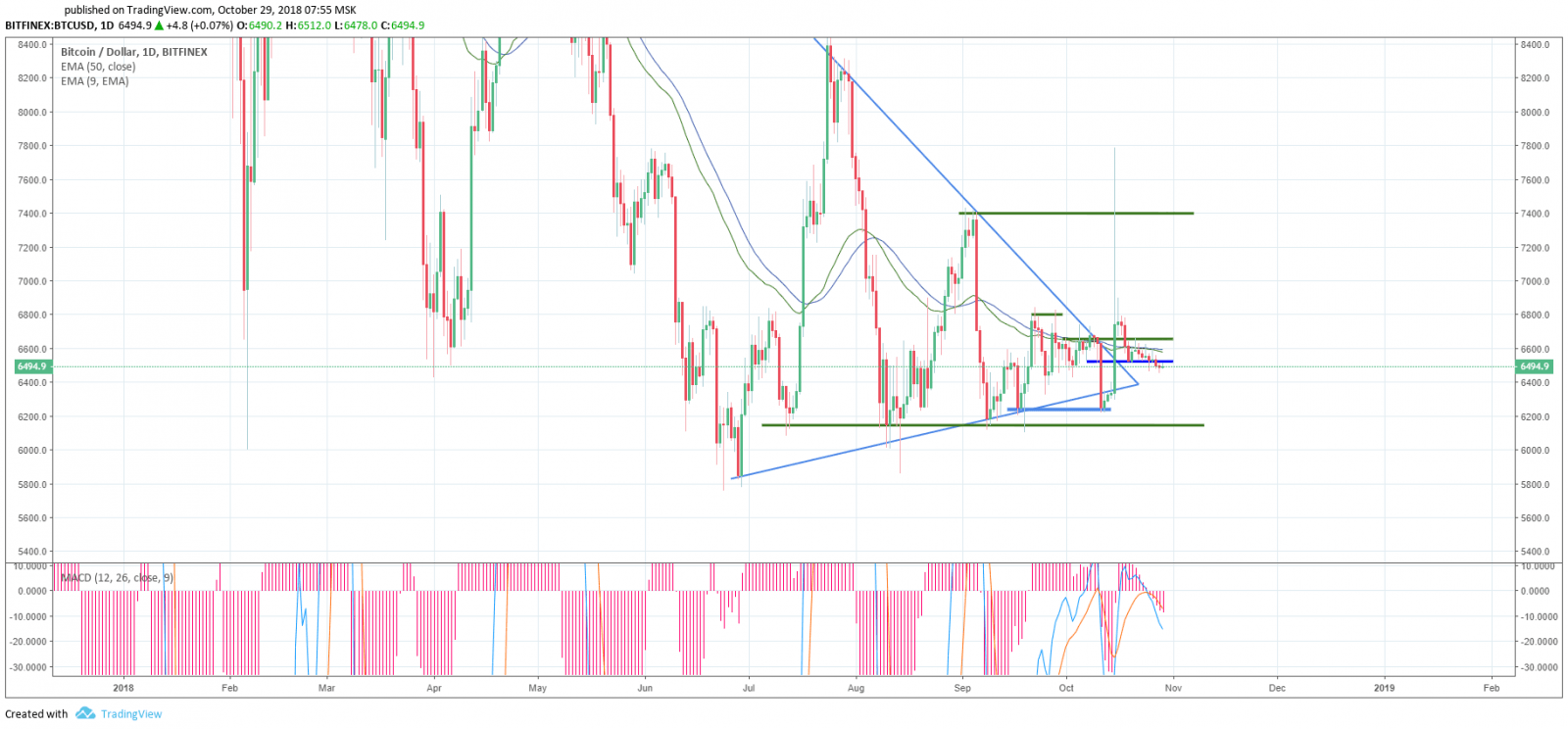

Daily chart

On the daily chart, you can clearly see the resistance level of $ 6,600, through which the fast EMA9 and slow EMA50 pass. Both indicators do not signal a decrease, and rather they are in a neutral position. MACD indicator in the trade area.

The news picture is still favorable.We already wrote about the positive changes of the regulation in Japan, as well as about the receipt of permission by the American cryptocurrency exchange Coinbase to provide custodian services for digital assets.

Well, another not less bullish news that appeared the other day: the Visa payment system may start working with cryptocurrencies in the future if it sees that they are becoming a real payment tool. According to Alfred Kelly, executive director of Visa, the company can help such cryptocurrencies like the Bitcoin and Ethereum break into global markets.

We remind of our strategy once more: we do not trade short, so our pending orders stay in the same places!

At the same time, important levels that will keep prices down remain the same — $ 6,500, $ 6,560, 6,620-6,660, $ 6,800. Overcoming them will give the bulls back the strength to test the $ 7,400 level that has already been broken through.

Significant levels that will hold back the price reduction are $ 6,450 (local minimum), $ 6,400, $ 6,335.

However, the market does what it does best — tests one’s patience an nerves. The worst significant trade cases that take place occurs on nerves, and it does not matter whether it is panic or euphoria. Never trade on emotions and just reread our past reviews!

Have a great week!

Share this with your friends!

Be the first to comment

Please log in to comment