It’s time to look at the market and understand what’s going on. On the night of October 24-25, we witnessed a $ 6,520 puncture on the BTC / USD pair, which could have been caused by a general fall in the...

It’s time to look at the market and understand what’s going on.

On the night of October 24-25, we witnessed a $ 6,520 puncture on the BTC / USD pair, which could have been caused by a general fall in the American market, however, not in the US only. Tradings on Wednesday, October 24, closed with such indicators:

- The NASDAQ Composite index fell 4.43%

- The S & P 500 fell 3%

- Dow Jones Composite Index — 2%

This is the second major drop in the US market since February (the NASDAQ lost 3.8% in a day back then). Following the US market, the Japanese fell as well: the Nikkei index dropped 3.7%.

However, our reader had been warned that in case of unsuccessful «double bottom» figure formation, the price could shift to the lower border of the $ 6,660—$ 6,520 trading range. The overall reduction of the «older brothers» could well contribute to testing the level of $ 6520, where the price is being traded at the time of writing the review. That’s what’s happening in the market.

Now, having one question less to worry about, let’s have a look at the charts.

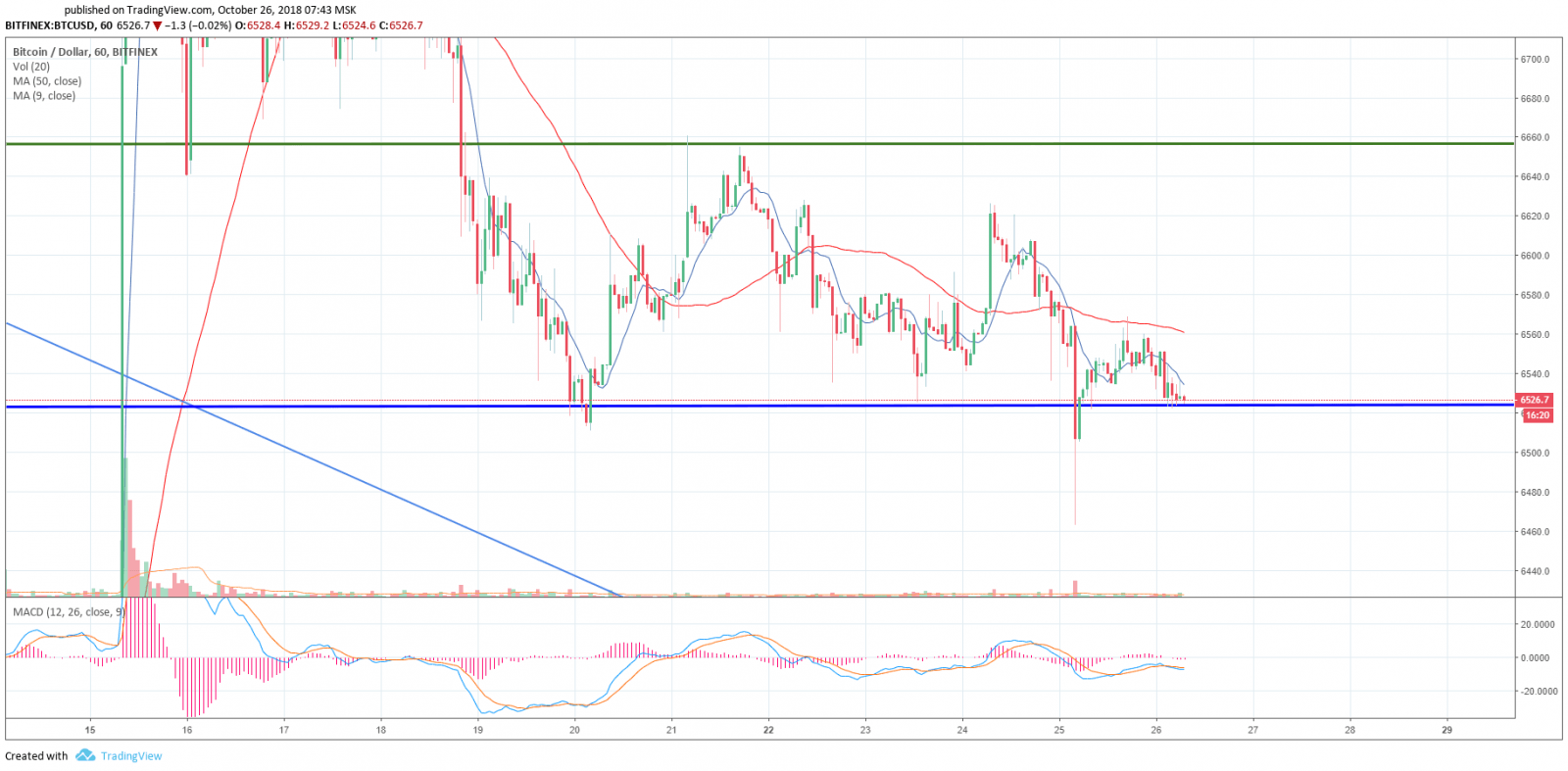

On the hourly timeframe, the price is still traded in the channel, limited by the levels of $6,660 and $ 6520.

Volumes remain low. MA9 and MA50 sliding averages are higher than prices and are aimed down. Slow MA50 can act as local resistance at $ 6,560.

The MACD indicator is located near the neutral area, being in the trade are itself. However, It is worth noting that with current trading volumes, one should not trust the indicators and rely on them, especially at 1H. At the same time, they cannot be ignored entirely.

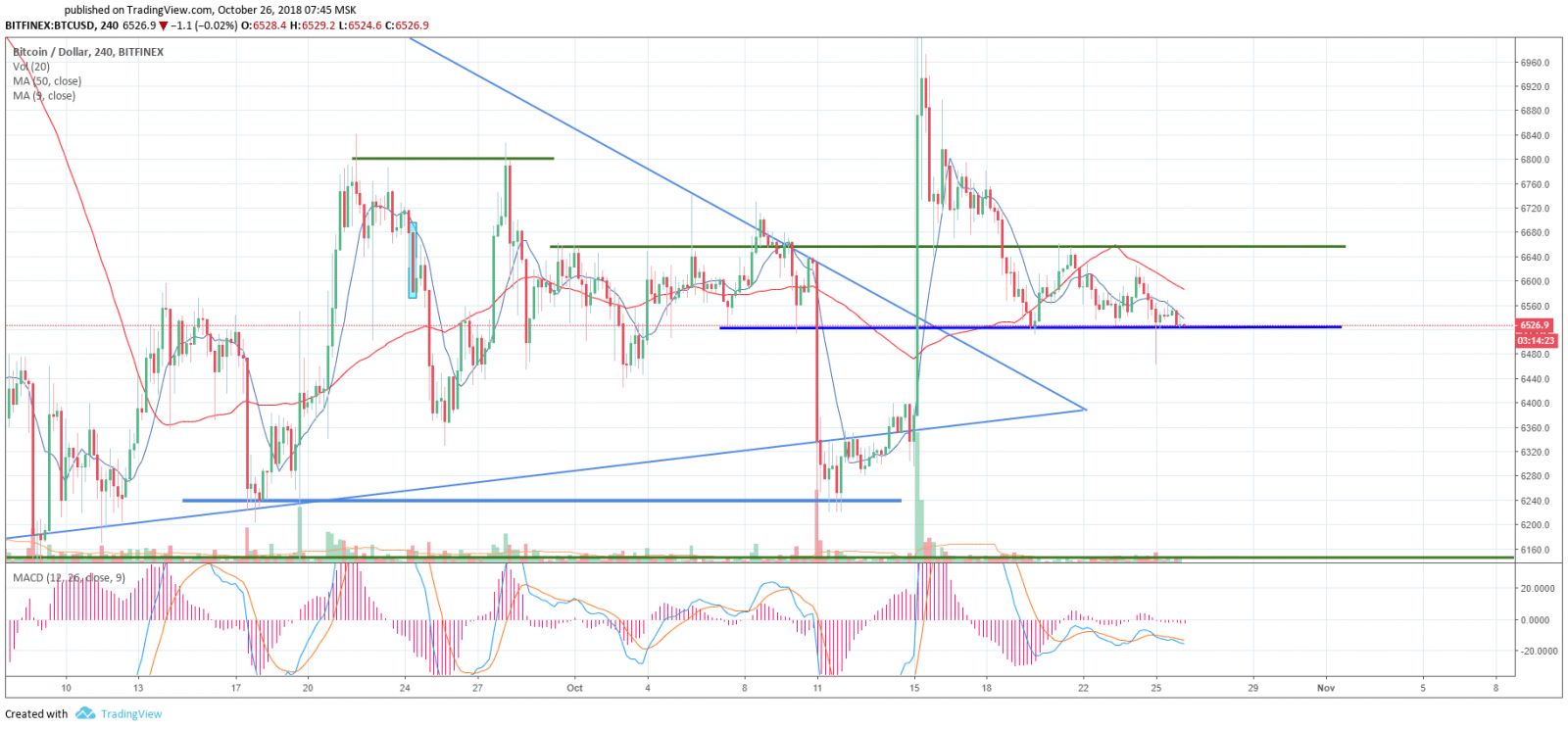

On the 4-hour timeframe, the price increase stopped at $ 6,625, from where the it began to reach the lower boundary of the channel. Touching the level of $ 6,462 and the instantaneous bounce up returned trading above the level of $ 6,520, where the price is located at the time of review writing. Sliding averages are located above the current price and are aimed down. MACD indicator is also in the trade area.

On the daily timeframe, the chart has hardly changed since our last review.

MACD is pressed to the neutral level. The MA50 slow sliding average runs parallel to the lower boundary of the channel, below the current price, providing support at $ 6,518. Fast MA9 is aimed down.

We once again notice that news is losing influence on the market. Even yesterday’s withdrawal of nearly 1 billion Tether from the turnover did not lead the market out of a sideways trend. Moreover, 966 million USDT tokens were withdrawn from circulation, 500 million were burned. On the morning of October 25, Tether’s capitalization dropped to $ 1.95 billion.

There are other, frankly «bullish» news: Japanese officials realized that the cryptocurrency industry is changing so quickly that the government does not have enough competences to react to these changes promptly. Therefore, the regulation of the branch of power will be handed over to the association of cryptocurrency exchanges. The association will independently establish rules for crypt exchanges operating in the country and take proper action against violators.

One of the main news of the week at the moment came from the US Securities and Exchange Commission (SEC). As yet known, the SEC refused to all companies that have applied for the opening of Bitcoin-ETF. At the moment, the SEC has papers from VanEck. Moreover, the SEC is in the process of gathering the necessary information for a final decision. In this regard, on October 9, the SEC held a meeting with crypto companies, where VanEck provided the required evidence of security and liquidity, indicating that the current stage of cryptocurrency market development corresponds to that of the first Bitcoin-ETF.

Another significant news was the permission from the Financial Services Authority of New York (DFS) for Coinbase to provide custodian services for digital assets. Cryptocustocdian is a legal entity carrying out professional activities for the storage and accounting of the amounts of clients cryptocurrency entrusted to it.

According to the regulator, Coinbase will be the subject to the same requirements as other traditional financial institutions in this field of activity. This fact can be regarded as a serious step towards the legal development of the crypto industry.

Bitcoin price forecast

Significant levels that will keep the rate growth are $ 6,560, $6,620–6,660, $ 6,800. Overcoming them will give the bulls back the strength to test the $ 7,400 level that has already been broken through.

Essential levels, which will hold back the price reduction — $6,520, $6,465, 6,400 $.

In general, the situation on the market is uncertain again and is undergoing tests of endurance for the market players. Protracted lateral movement provokes rash acts.

Have patience, ladies and gentlemen, and stay calm! We do not commit rash acts, do not chase the price, but make the profit level by level. At the same time, we save your time and minimize trade losses. Yes, we do not aim for scalping, and, as a result, our readers do not get grey hair at the slightest price fluctuation ;)

Share this with your friends!

Be the first to comment

Please log in to comment