On September 11 we saw a false breakthrough downwards. A sudden plummet to the $6,127 price (marked by the arrow on the hourly timeframe) and correction to $6,320 knocked out many traders’ stops. It reminds us...

On September 11 we saw a false breakthrough downwards. A sudden plummet to the $6,127 price (marked by the arrow on the hourly timeframe) and correction to $6,320 knocked out many traders’ stops. It reminds us once again of the unpredictability of the market and the need to be careful.

As of this writing, the market capitalization is $189,442,712,921, we see a decrease against the previous review and BTC domination has reached its yearly maximum of 57.4%. We can see that capital outflow from altcoins is continuing. The current picture on the market is not yet promising a reversal.

Everything on the daily timeframe is indicating further decrease so far. The first support is the $6,100 level, and should the bears gain a foothold below this level, further decrease down to the $5,800 level is quite likely.

To start moving up, the BTC/USD pair first needs to get over the $6,400 level paving the way to $6,600 and then to $6,900, whereupon the $7,400 level may be tested.

While the trades are within a narrow range between $6,190 and $6,320 it is very risky to open deals in the both directions for “scalping”, as the probability of false breakthroughs up and down remains very high.

The both scenarios are quite probable and expected by both the bears and the bulls. Our advice would be as follows: if you do not want to miss the expected growth, you can place a pending buy order below the current trading range, not forgetting the stops. The best strategy, however, would be to wait until the picture clears up, as any scenarios are possible in the market.

What about the news?

Looking at the news picture, the past week was full of events related to institutional regulation. Valdis Dombrovskis, Vice President of the European Commission, said that cryptocurrencies would coexist with the financial system; Nasdaq is going to issue a crypto analytics tool for investors; Citigroup shared its plans to support a crypto asset storage; and the Winklevoss twins, the founders of Gemini, launched a fully regulated and licensed stablecoin in the market called the Gemini Dollar (GUST).

Europe pressing forward?

As we can see Europe is trying to show a real impetus in the crypto market growth, but it is still lagging behind the US, South Korea and Japan: at the moment, the daily trading volume growth on South Korean exchanges is greater than that on all European exchanges. However, Europe’s positive outlook suggests higher probability that the European market will take dominant positions in the global sector in the near future.

ICOs no more?

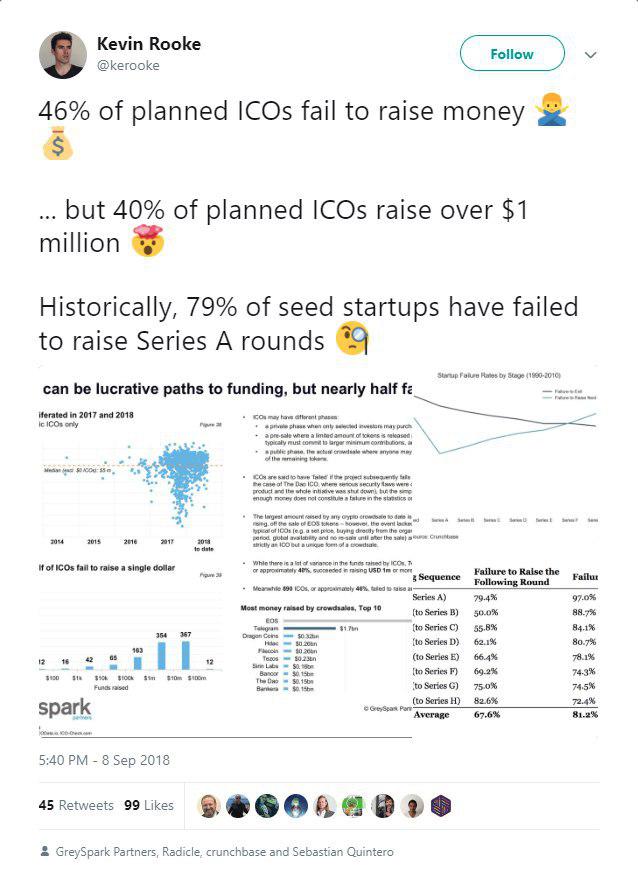

Moreover, the hype generated around ICOs continues to decline. SEC takes project founders to court time after time. A major study recently issued by GreySpark Partners research company shows that 46% of ICOs issued since the beginning of 2017 proved to be loss-making. Moreover, a great number of start-ups, after a successful launch, started bringing losses.

Experts note that it is technical and marketing loose ends left by project teams that may lie at the root of the decline. Unfortunately, GreySpark Partners does not cite any figures referring to the number of fraudulent ICOs. Analysts, however, do note the growth of cryptocurrency hedge funds, which they project to number between 160 and 180 by the end of 2018.

We have been seeing lately that global news have lost their influence on the market. Analysts agree that most likely we will not see bitcoin’s former volatility, when the news about the introduction of futures raised its rate to record highs, any more.

Share this with your friends!

Be the first to comment

Please log in to comment