Varo Money is one of the startups, whose creators believe that the time has come for serious changes in the traditional banking sector. Most of the banks work on relational principles, which were laid long...

Varo Money is one of the startups, whose creators believe that the time has come for serious changes in the traditional banking sector. Most of the banks work on relational principles, which were laid long before digital technologies. The system, which offers Varo, is designed to improve the financial condition for customers and gradually ensure the financial development. Modern technologies will be able to provide personalized assistance for more people.

The startup has already attracted $ 45 million for the development of the mobile platform, having received direct investments from Warburg Pincus and The Rise Fund and TPG. Investors believe that today there is an opportunity to build a more economical and user-friendly platform, focused on the generation of the Millennials.

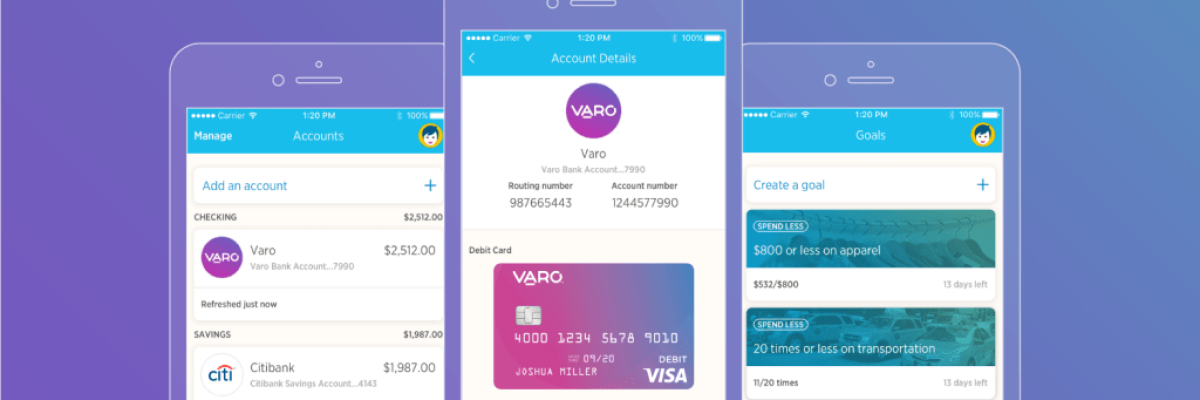

Unlike other fintech applications that attempt to contrast targeted solutions with the traditional model, Varo's mobile banking service will integrate basic banking products (deposits, savings and lending) with financial instruments (cash flow projections, cost tracking and intellectual warnings). Such a combination of integrated financial solutions and proprietary technologies will make the banking services publicly available.

Each client will learn to spend less than he earns and will gradually create a personal reserve fund for 3 months. In addition, financial development involves improving the credit profile, planning insurance risks and major life events.

Colin Walsh, Varo Money CEO believes that young people want something really simple and intuitive.

Varo offers a bank account maintained by the Federal Deposit Insurance Corporation (FDIC) and Bancorp Bank. Thus, the startup has already entered the market with an FDIC insured product and is able to compete with existing banks. In the future, the company is going to create its own bank.

Varo customers are provided with loans calculated by machine learning. The algorithms developed by Varo programmers help to forecast revenues and expenses and offer clients to take a loan at the right time.

One of the main advantages of the platform is the absence of any commission fees. For example, customers do not have to pay for exceeding the loan amount or for foreign transfers. The only additional fee is charged for using ATMs of banks that are not partners of Varo Money. And the list of affiliate ATMs nearby can be found in the mobile application.

The startup, launched in June last year, already has tens of thousands of customers. The creators of Varo Money intend to lay the foundation for the creation of a true national bank that will ensure the financial well-being of customers in the short and long term.

Share this with your friends!

Be the first to comment

Please log in to comment