Hello everybody. I once again come to the conclusion that many market participants simply enjoy permanent suffering and emotional turmoil. And yesterday’s BTC/USD slump is a clear proof of it. Dozens of...

Hello everybody. I once again come to the conclusion that many market participants simply enjoy permanent suffering and emotional turmoil. And yesterday’s BTC/USD slump is a clear proof of it. Dozens of articles with panicky headings on the market’s speedy plummet immediately appeared in the network.

What causes do mass media outlets cite? BTC Mt Gox sale – is it the cause of the market drop?

Yesterday, on September 25, Mt. Gox managing partner published the document entitled “Announcement on Measures to Secure Interests of Bankruptcy Creditors” that discloses information on the cryptocurrencies including BТС and BTH, sale for the value of $230mn. It emerged that over six months, it sold cryptocurrencies for a total of $230Mn. Yesterday’s correction exactly coincided with the release of this document.

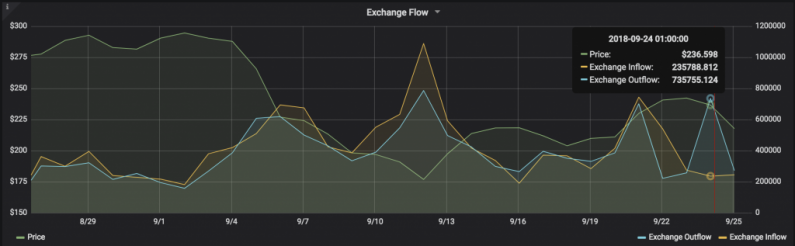

Moreover, judging by the dramatic drop of the Ripple price - it lost 16% yesterday; the coin is being aggressively sold. Ethereum- the second cryptocurrency - is following the same trend – on September 24 the cryptocurrency exchanges’ balances went down by half a million Ethereum coins.

Trustnodes survey shows that, within a day, users deposited 235,000 ETH and withdrew 735,000 tokens. Experts believe that users are afraid to keep their ETH in exchanges opting for cold wallets rather than hot ones. We have not witnessed such a speedy outflow of ETH for a long time. The previous time 1, 800, 000 ETH were withdrawn on 22 February 2018.

But is there any good news?

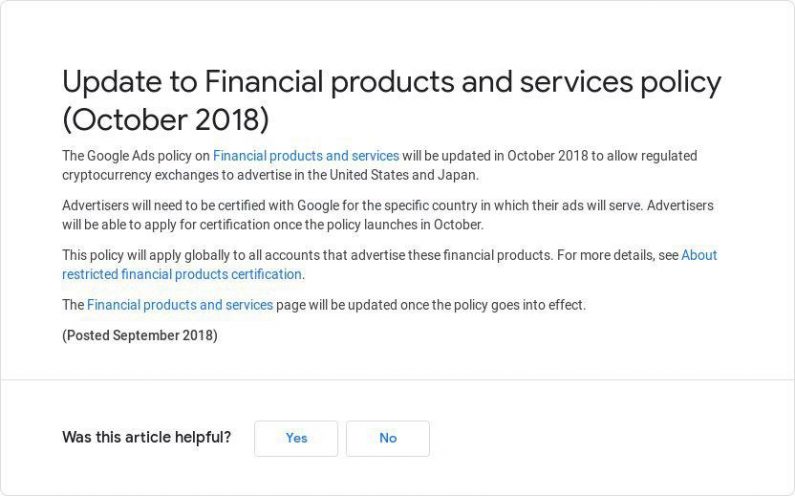

Google, after Facebook, has made a decision to lift the ban on cryptocurrencies advertising.

Google intends to update its cryptocurrencies policy in October 2108.

The ban will first of all, be lifted for advertisers from the USA and Japan – the citizens of these two countries will be allowed to advertise regulated crypto exchanges.In May, Google announced restrictions on advertising related to “crypto resources” and content related to them” (including, but not limited to ICO, cryptocurrency exchanges, wallets and recommendations on cryptocurrencies trading)”.

Early this year, all internet giants (Google, Facebook, Twitter и Snapchat) were categorical on the cryptocurrencies topic and prohibited all types of advertising. But we are now witnessing an emerging “thaw” in the companies’ advertising policies – they have started, with some restrictions, to accept ads.

What do the charts tell us?

In fact, the price dropped and pierced the $6,328 level but quickly bounced back to the current (at the time of writing) $6,400.

The day chart shows that trading occurs in a narrow triangle. The waves’ dispersion reduces within the limits of its sides. The price is currently near the lower border of the ascending channel (See the Chart). In case of a decline, the price will be contained by the support levels – within $6,300 - $6,200 range; the psychological level is $6,000 and this year’s minimum $5,755

The first target for a continued ascending movement will be $6,600, then $6,800. Exit up from the triangle up will open way to $7,400.

Within the hour timeframe we can see completion of the reversal pattern “inverse head and shoulders”; when it is completed, the price may go up. But we want to draw your attention from the outset to the “timeframe strength” – the shorter the timeframe, the weaker it is.

What needs to be done now?

By any means, do not fall for information noise and do not try to trade on the news. Our trading strategy is not about chasing orders that are “opened on the news”. We trade on BITCOIN rising price and have done very well so far. We work strictly on the targets. That is why we recommend to keep a part of open buy orders and if the price goes down from the current levels – to buy some more. You can put stops on the support levels from $6,200 to $5,800.

Share this with your friends!

Toney

I have been browsing online greater than three hours lately, but I by no means discovered any attention-grabbing article like yours. It's lovely value sufficient for me. In my view, if all webmasters and bloggers made good content as you probably did, the web will likely be much more helpful than ever before. Ahaa, its fastidious dialogue regarding this post here at this web site, I have read all that, so at this time me also commenting here. I'll immediately grab your rss as I can't in finding your e-mail subscription hyperlink or newsletter service. Do you have any? Please allow me know so that I may just subscribe. Thanks.