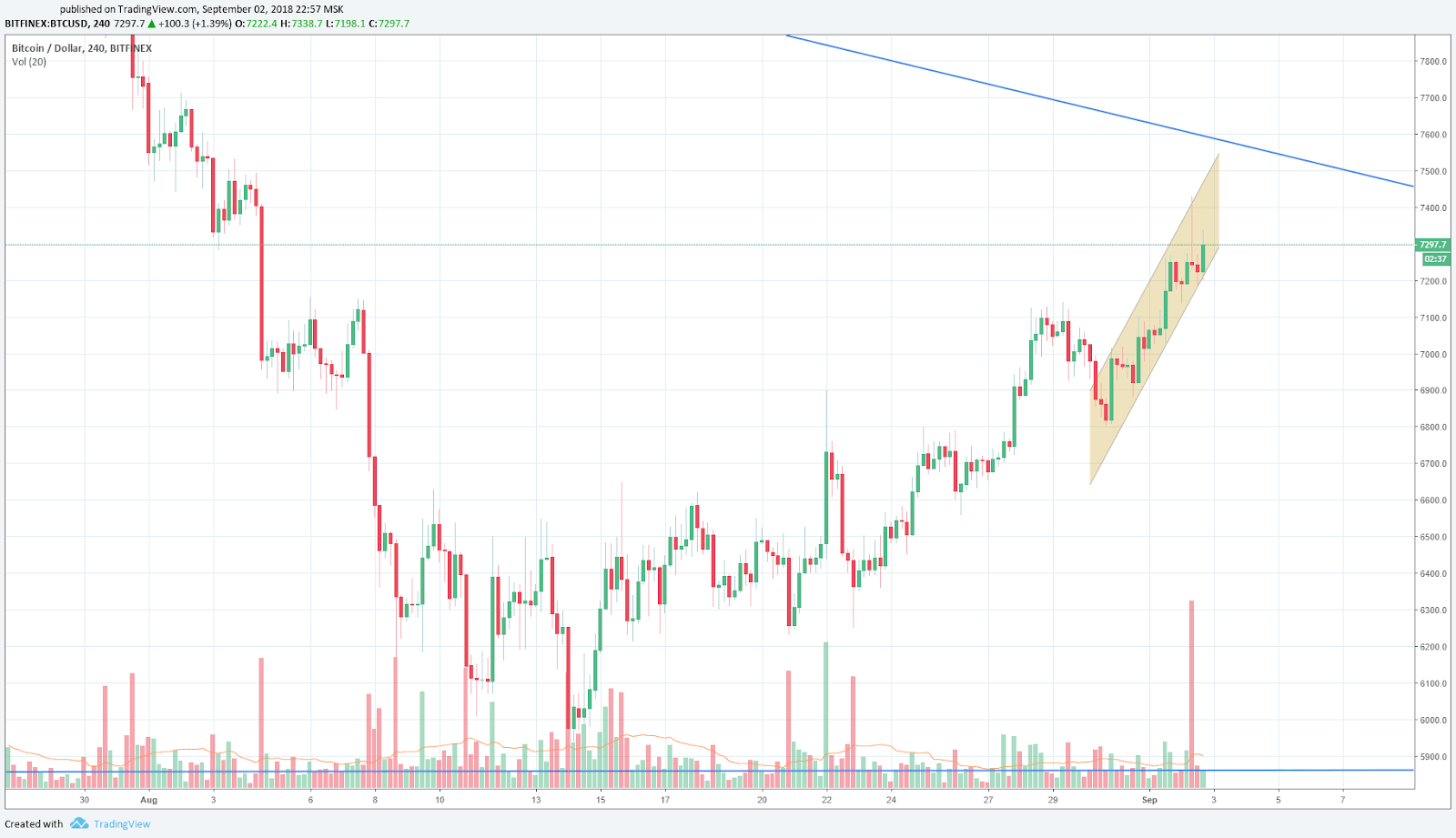

The BTC/USD pair continues to move within a narrow local channel. In the first part of September 2, BTC/USD in a sudden spike upward shot over $7400 (which we wrote about earlier) followed by an instant...

The BTC/USD pair continues to move within a narrow local channel. In the first part of September 2, BTC/USD in a sudden spike upward shot over $7400 (which we wrote about earlier) followed by an instant correction. As the likely scenario of its movement in the next few days, if the price does not fall below $ 7,200$ - $7,150, we see it making its way into the $7,500 - $7,550 range.

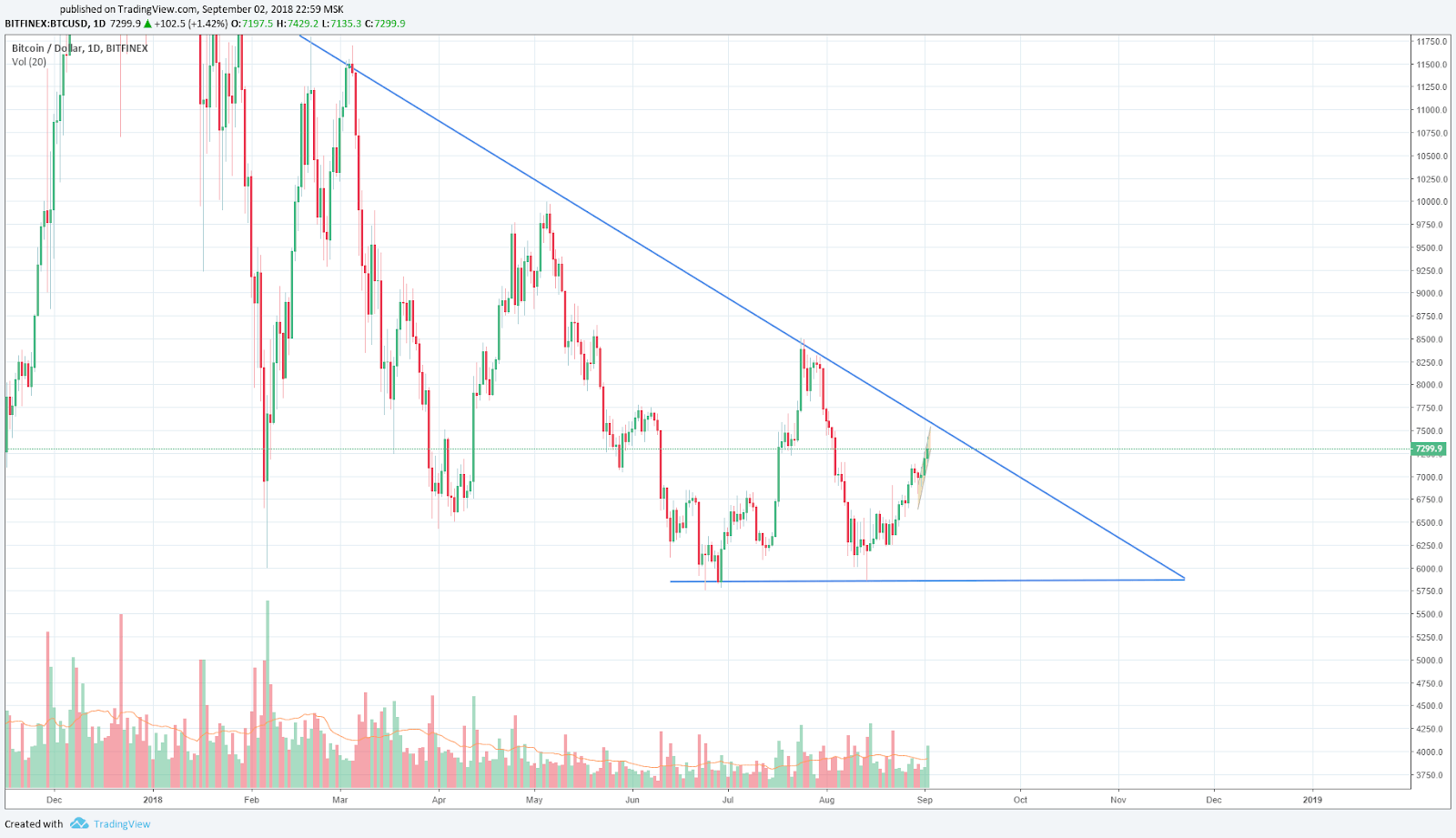

1-day timeframe shows that the pair is approaching the upper boundary of the triangle, the breakout of which will be a signal for further growth and return of the pair to the level above $8,000.

We would like to draw your attention to the issuance of 100 million USDTs on September 2 that were sent to BITFINEX wallets. There can be two assumptions here: either somebody decided to buy big time or somebody is waiting for the price to fall to buy at a lower price. A similar transaction was made less than two weeks ago. It was a short-term market upswing which pretty much halted the next day. However, the rising trend continued and the price broke through the $7,000 mark.

As at the time of writing, the market capitaisation is $237,390,239,796 – there is a minor growth, but the trading volumes are still small. The bitcoin domination is 52.8%.

UPD

Currently, the pair is consolidating in a very narrow range, with an upward tendency. According to our forecasts, in case of overcoming the current resistance line, the pair will go to $ 7400 and above, but if the level is not maintained, we will see the price around $ 6800.

Share this with your friends!

Be the first to comment

Please log in to comment