Hello! Not much time has passed since our previous review, and the price has almost worked through all the levels. A short ascent ended in a sharp drop. It proves once again that you shouldn’t trade...

Hello!

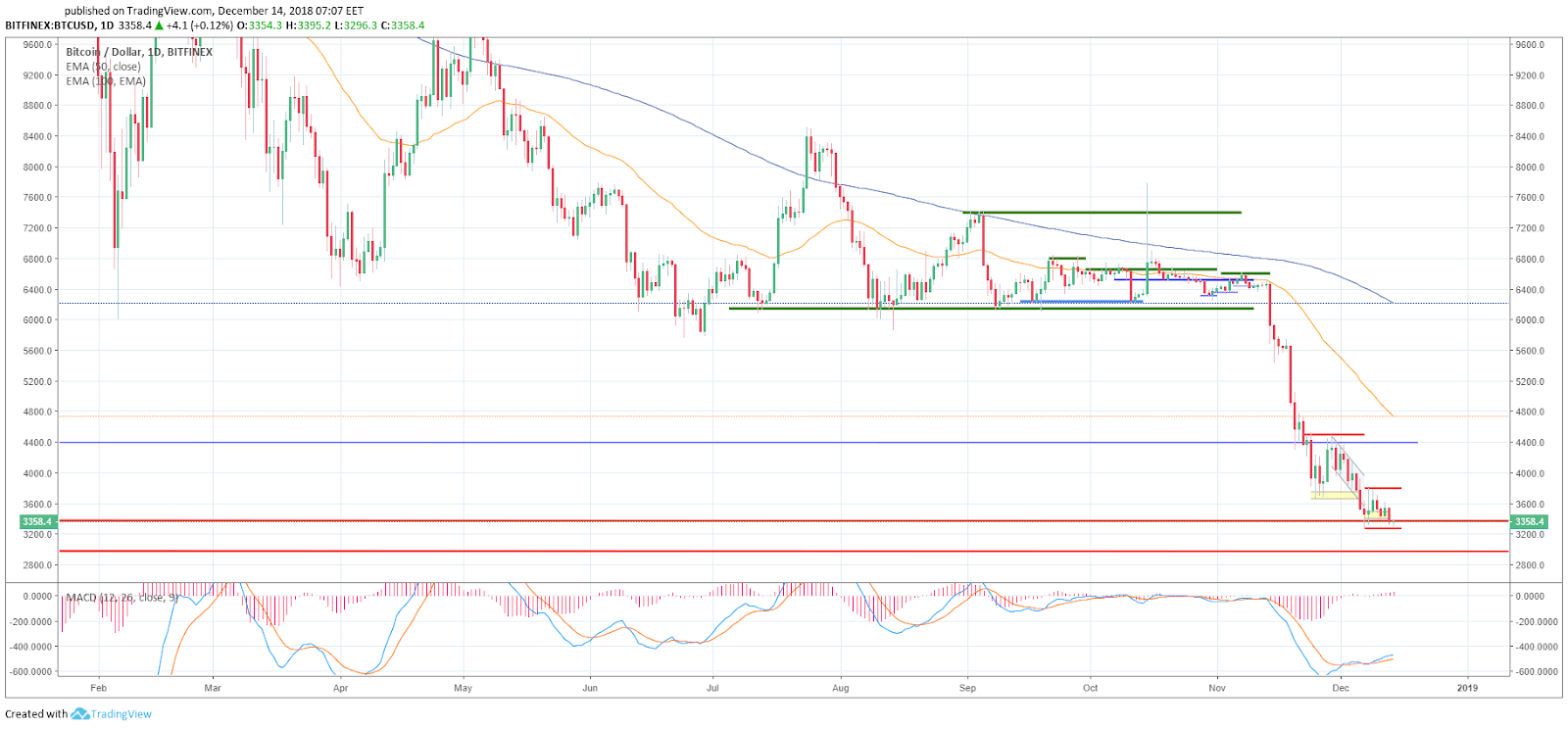

Not much time has passed since our previous review, and the price has almost worked through all the levels. A short ascent ended in a sharp drop. It proves once again that you shouldn’t trade on emotions. Let’s see what the market situation is like today.

One hour chart

A new all-year minimum has not been reached. Bitcoin found support near the $3,300 level (between $3,335 and $3,300). The moving averages are above the price, but the MACD indicator is in the sell zone reversing upwards. After the current consolidation a re-test of the all-year minimum ($3,277) is likely to occur. Buying long positions at the current levels cannot be excluded. We won’t do any guesswork. ЕМА50 at $3,444 and ЕМА100 at $3,521 will contain growth. When EMA50 crosses to the upside of EMA100 this will signal an ascending movement; until then it would be premature to speak about an upward trend.

4-hour chart

The indicators on the 4-hour timeframe suggest a continued descending movement. The MACD is in the sell zone and is not going to reverse. The moving averages are above the price and looking down. For the price to grow, it has to overcome the resistance at the of $ 3,570 level and consolidate above $3,600- $3,620. The entire-year minimum of $3,277 acts as the support.

On the day timeframe, trading is near the year- minimum which does not exclude its re-test in the near future. The MACD indicator is deeply in the sell zone and looking upwards. There is no clear growth signal. The moving averages are high above the price and suggest that a decline is a priority.

We should also keep in mind that it’s the year end: the time when the market participants close positions to lock in profits or losses. This may lead to a further price decline. Therefore, it is better not to trade in the short term.

We wish you an enjoyable weekend!

Share this with your friends!

Be the first to comment

Please log in to comment