As it is Friday today, it’s high time we take stock of the week and count the profit! Hourly chart The BITCOIN price continues to move in the upward channel we identified in our last review. On November 7,...

As it is Friday today, it’s high time we take stock of the week and count the profit!

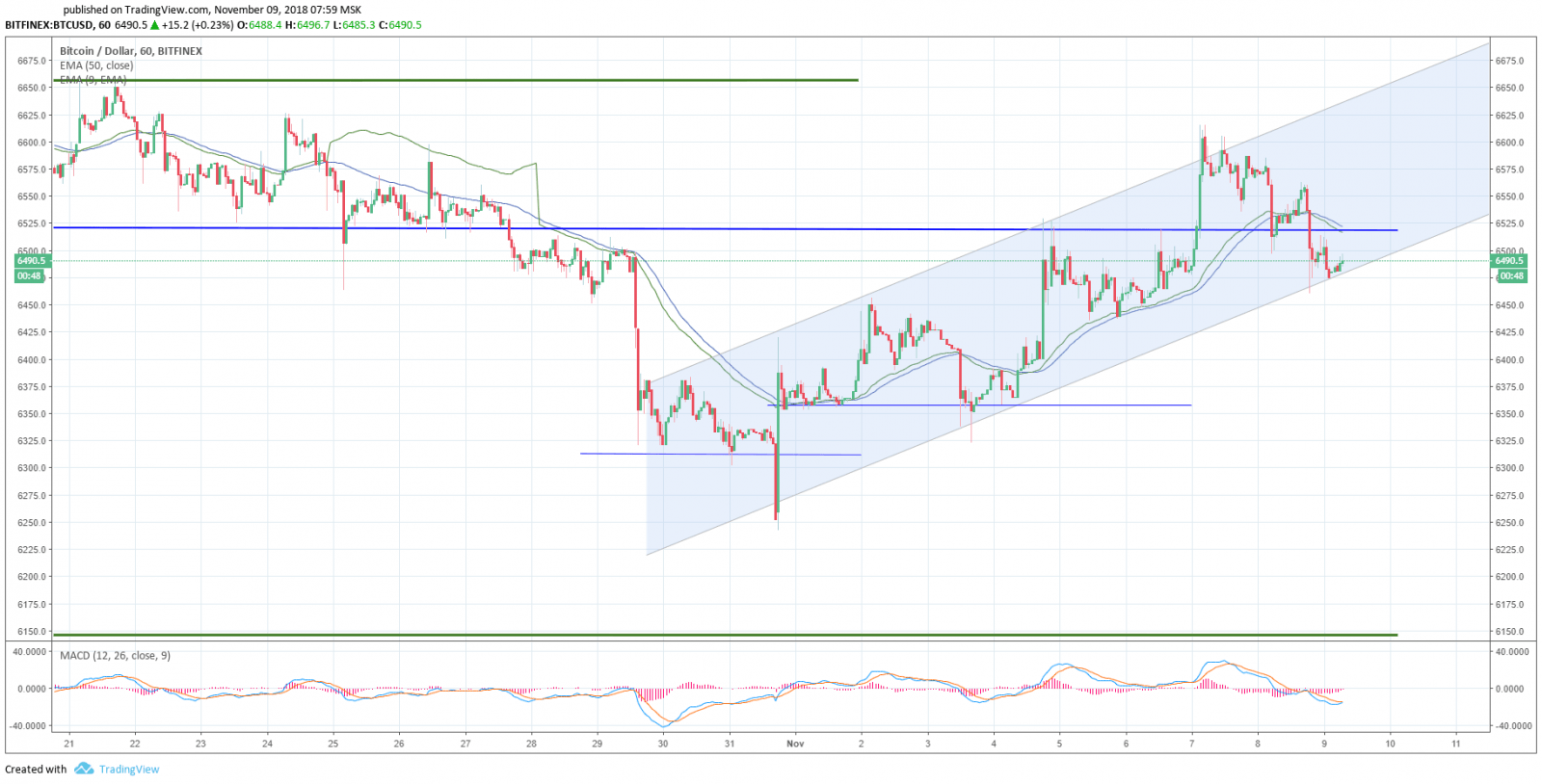

Hourly chart

The BITCOIN price continues to move in the upward channel we identified in our last review. On November 7, it made an attempt to go beyond the channel limits, but from the $ 6,615 level the price corrected back to the channel range where it is being traded at the time of this writing.

MACD indicator is in the sell area showing the signs of turning into a buy one. The both EМАs are located above the price. ЕМА50 will act as local resistance at the $6520 level we have already seen.

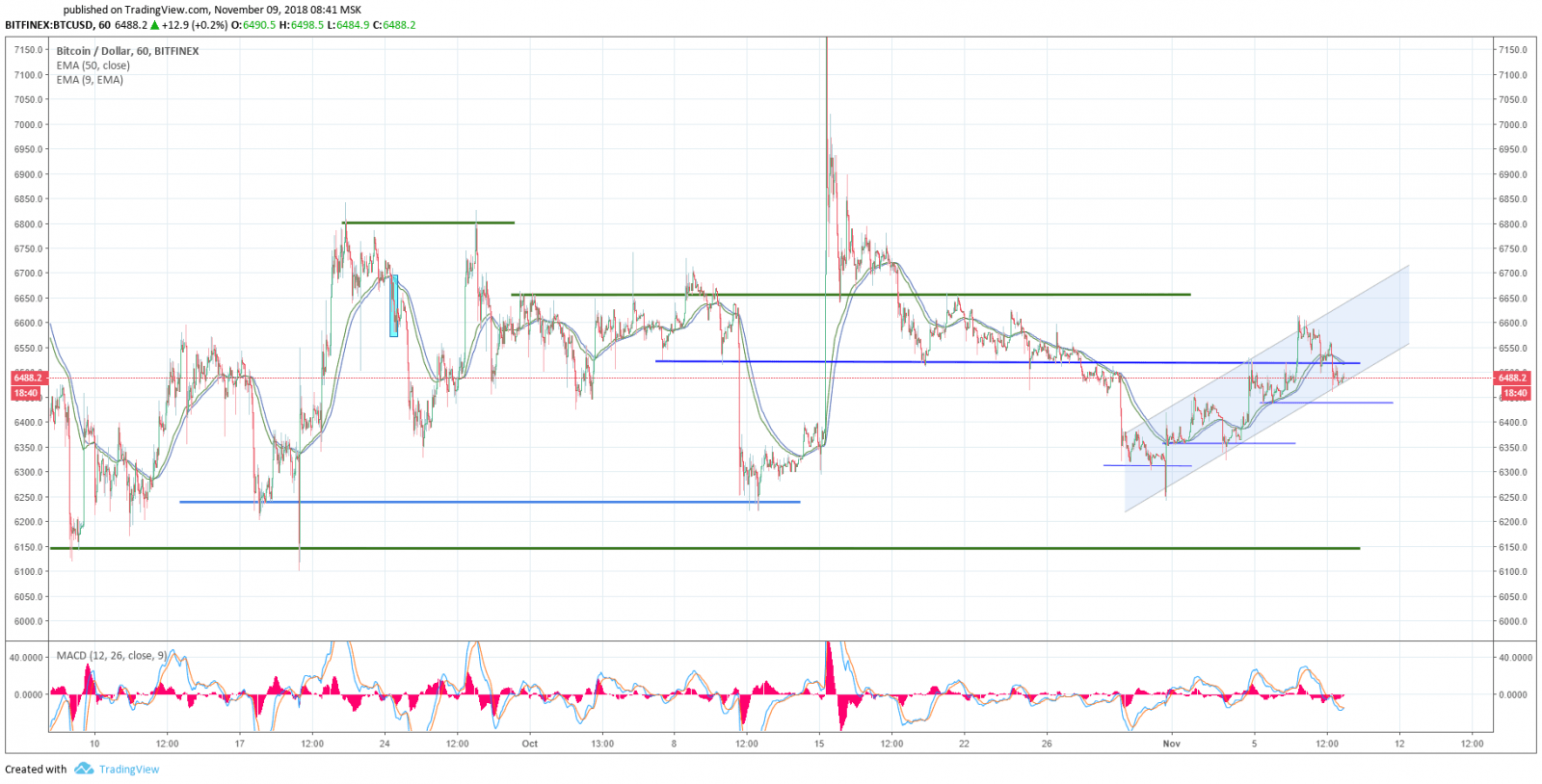

Four-hour chart

On the 4-hour chart, yesterday’s price decrease helped to «unload» the indicators that were overbought. ЕМА9 and ЕМА50 are located under the price.

ЕМА50 serves as local support at the 6480$ level, and while the price touches the lower boundary of the upwards channel, there is still a probability of the upwards movement resuming.

Daily chart

On the daily timeframe, MACD indicator shows an increased interest in trades on the part of the bulls. ЕМА 50 has been above the price for a few days now and has taken a horizontal position.

In total, what do we have by Friday? Definitely, the profits made by our readers!

All quiet in the crypto market?

Over the last few days, the market has seen record low volatility levels in bitcoin futures. Kevin Davitt, a senior instructor at the Options Institute at Cboe Global Markets, notes that in October, bitcoin futures volatility reached its historic lows since December 10, 2017. The average volatility rate in October was only 6.6%. According to the analyst, futures reflect the decreasing bitcoin volatility.

There is also news on the bull side. Bitmain, a leading mining equipment manufacturer, announced the release of its new line of ASIC mining devices — Antminer S15 and Antminer T15 — equipped with 7 nm chips. The ASICs were sold out very quickly.

What’s new with BITCOIN?

Important resistance levels are $6,500 — $6,520, $6,615 (maximum on November 7), $6,650, $6800.

Important support levels are $6,440, $6,350, $6,310, $6,242 (minimum on October 31), $6,150

Bitcoin is still being traded within the limited $6150 — $6800 range, and the image above clearly shows the levels, where the price will find support/resistance. For the market to turn upwards and start growing steadily, the price needs to get above the $6,800 level.

We congratulate you, our readers, on the profits made and wish to remind you of the dangers of making spur-of the-moment decisions in the market. Have a great weekend!

Share this with your friends!

Be the first to comment

Please log in to comment