We hope your weekend went well. And now, without slowing down, let’s have a look at the outcomes of the last week’s trading and identify possible movements of the BITCOIN price for this week. Over the last two...

We hope your weekend went well. And now, without slowing down, let’s have a look at the outcomes of the last week’s trading and identify possible movements of the BITCOIN price for this week. Over the last two days, total market capitalisation went up by $8 billion and is $112 billion at the time of writing.

Last week the BITCOIN price sank to its 2018 new minimum dragging down most altcoins. By the way, altcoins prices plunged 90% in 2018 against their all-time maximums.

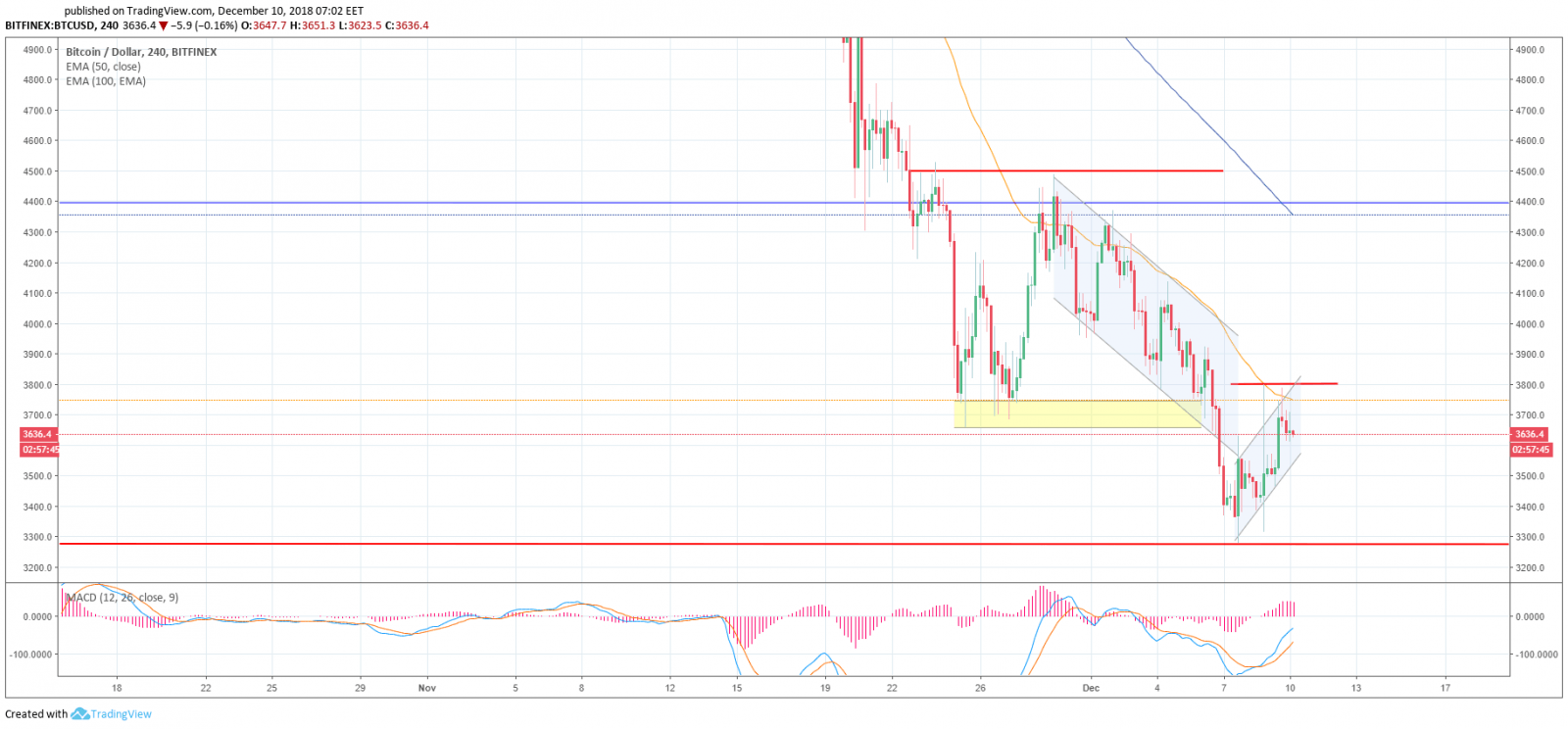

The bears failed to push the price down to $3,000, but they still managed to drag it down to its new all-year low of $3,277 and from this level the bulls continue to push the price up. Thus, the momentum returned the all-year minimum price up to somewhere near $ 3,500. Currently, the price is moving in the ascending channel that emerged on December 7. At the time of writing, the price, pressed between the ЕМА50 and ЕМА100 moving averages, is between the channel’s upper and lower borders.

EMA50 is under the price acting as the local support at $3,851; at the time of writing, EMA100 at $3,646 is restraining growth.

The current target for the bulls is $3,800, which they have already stormed several times with each attempt followed by a sharp drop. It is noteworthy that the EMA50 moving average has turned upward and is trying to cross the EMA100 from the bottom upwards, and if this happens, the 1 hour chart will form a buy signal. The MACD indicator is in the buy zone, but is reversing down, — possibly for unloading.

On the 4-hour timeframe the EMA50 moving average acts as a local resistance at the $3,749 level. The MACD indicator is rising to the buy zone. There is a probability of descent towards the channel’s lower border for accumulation of positions.

The day timeframe

One of possible scenarios is that the price is now drawing an «inverted head and shoulders» figure — the left shoulder is November 25-26, the head is the current year minimum of December 7 and the right shoulder should be formed on December 20-29. Under this scenario, the price may return to the $4,400 area and then start working through the right shoulder sinking to $3,700 — $3,500.

This scenario looks attractive exactly at the year-end, as such a powerful pattern as «an inverted head and shoulders» on the day timeframe will be a positive growth signal for early 2019. Moreover, one cannot deny that a correction is needed after such a long decline.

We will keep this scenario in mind.

The price is currently under the ЕМА50 and ЕМА100 moving averages which are looking down. The first resistance is the $3,800 level, support at $3,580 — $3,550, the risk of decline to the $3,300 level remains.

News background

It is noteworthy that the network’s hash rate decrease has been lately accompanied by a declining complexity of mining. Recently, we have seen its second major decline in history when it dropped by more than 15%.

By the way, large sums of money have migrated in the networks lately. Between December 3 and 4, three transactions worth 199,000 BTC were made in the Bitcoin network. The same is happening in the Litecoin network: on November 30, a large 35.4 million LTC-worth transaction was effected, which equals 60% on offer on the market.

Recommendations for today

The $3,400 level is an attractive one to gain long positions and you can clearly see this on the chart.

We wish you all profits and a productive week!

Share this with your friends!

Be the first to comment

Please log in to comment