«To the Moon?» is the most popular question in all chats as soon as the price makes the smallest upward movement. It is precisely such messages that trigger inflated expectations leading deplorable outcomes....

«To the Moon?» is the most popular question in all chats as soon as the price makes the smallest upward movement. It is precisely such messages that trigger inflated expectations leading deplorable outcomes. In order not to trade in expectations, let’s have a close look at the charts.

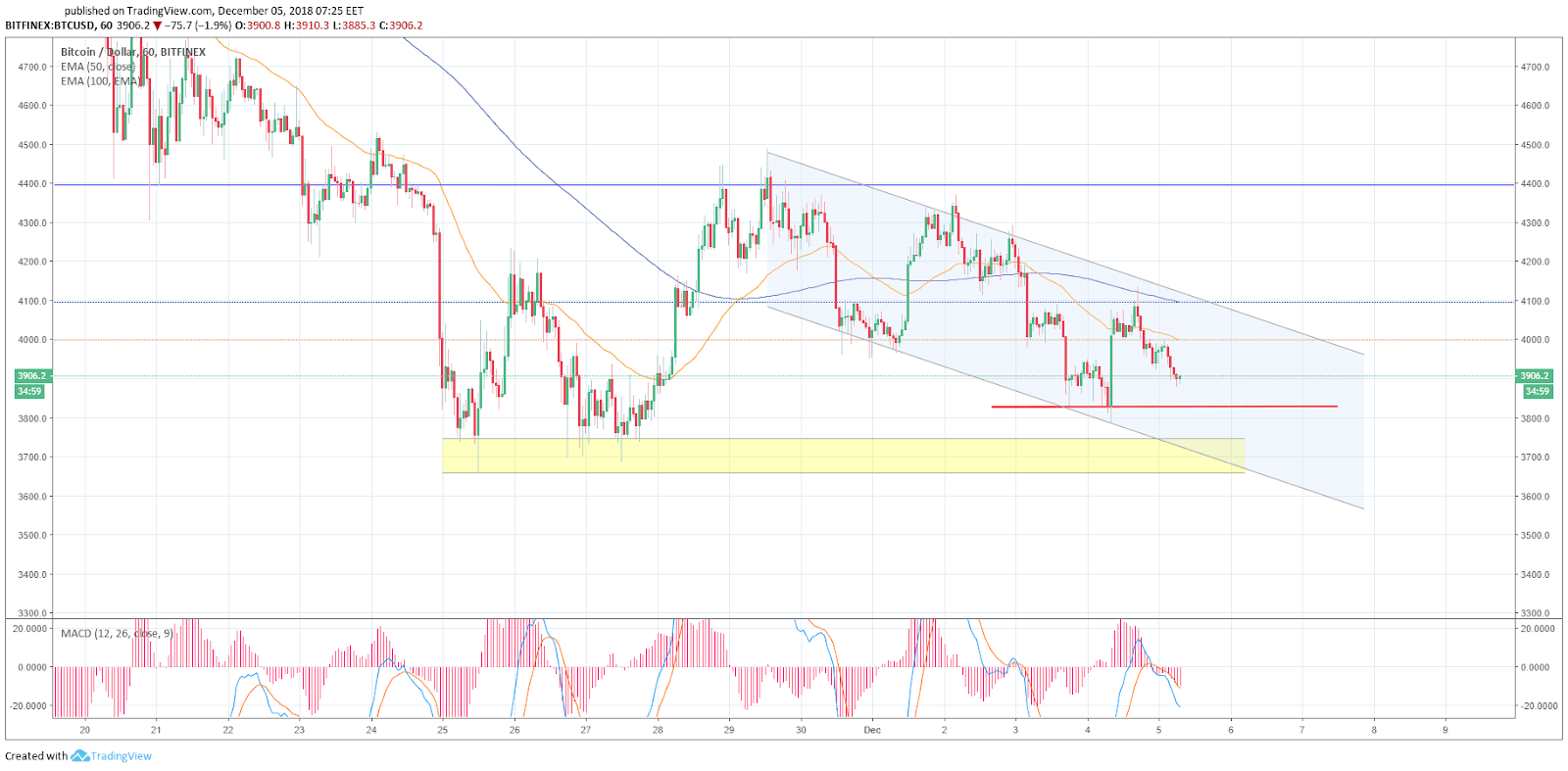

1 hour chart

Yesterday, on December 4, the bulls tried to go above ЕМА100, but failed to consolidate above the moving average. The BITCOIN price reached $4,135 and from that level went down again.

Trading has been in the descending channel since November 29 and, judging by the price behaviour, the decline will continue today. The moving averages are above the price on the chart and «looking» down which also suggests a continued descending movement.

One can trade within the channel only from the margins, but it would be preferable to suspend trading, if you are not used to risk. The $3,785 level which is the 4 December minimum will act as the first support.

If it fails, we will see testing near the year minimum (the yellow area on the chart). The MACD indicator is in the sell zone but showing signs of reversal.

$4,000 (EMA50) and $4,100 (EMA100) act as resistance levels. The latter is very close to the upper margin of the channel and overcoming and consolidating above it will open up the way to $4,400 level.

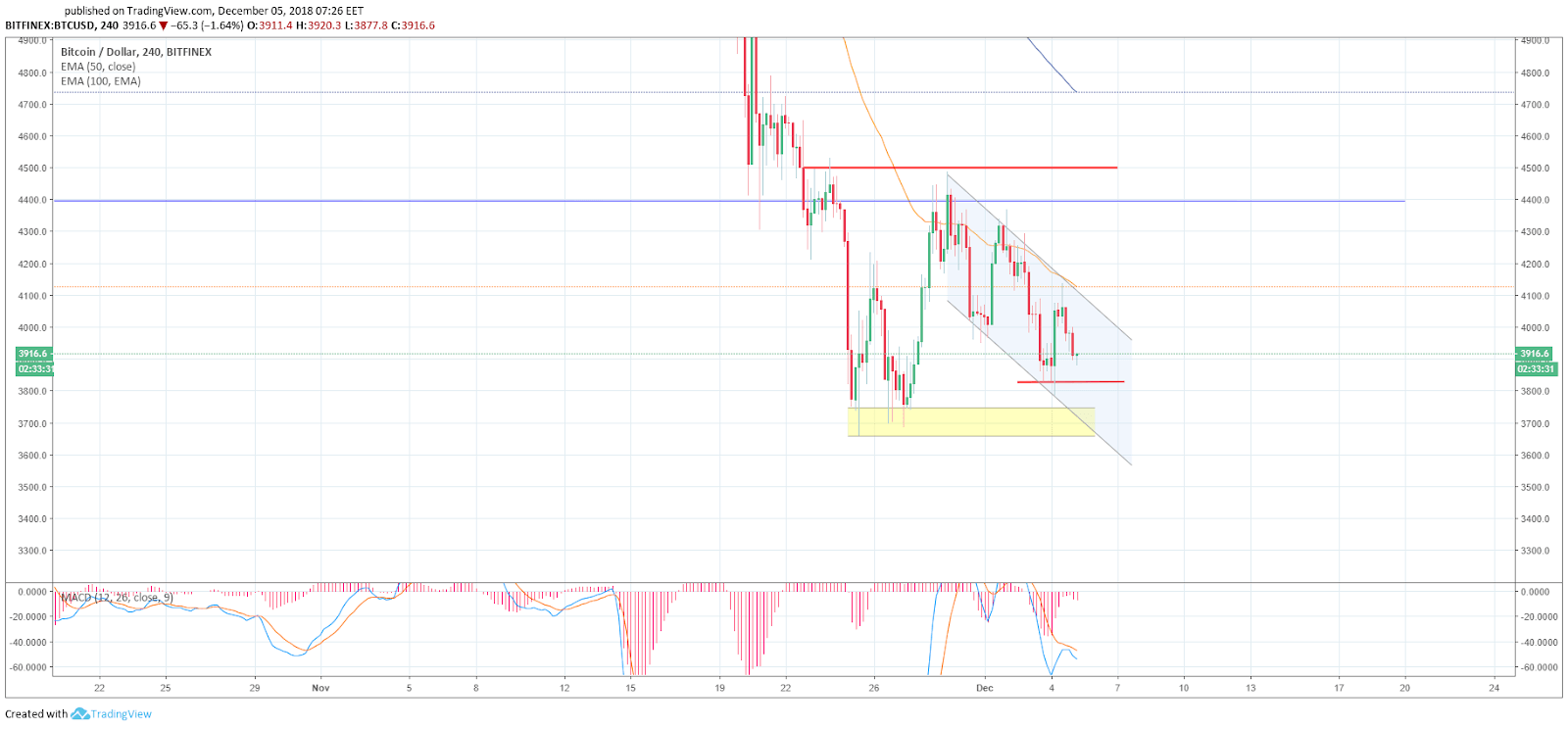

4 hour chart

Both EMA are above the price on the chart and also ‘looking" down. The MACD indicator is in the sell zone. EMA50 at $4,127 level will act as resistance to the upward movement. It would be too early to speak about an ascending movement until it breaks through EMA100 upwards. The price is currently trading in the descending channel near the year minimum.

A lot of large buy orders are located a little below this year’s minimum near the $3,500 (and down to $3,000) level, but the price is bought pretty well already on the current declines. The support near $3,800 level currently prevents the price from going down. In order to get a clear picture, it is best to wait for the puncture of the channel in either direction.

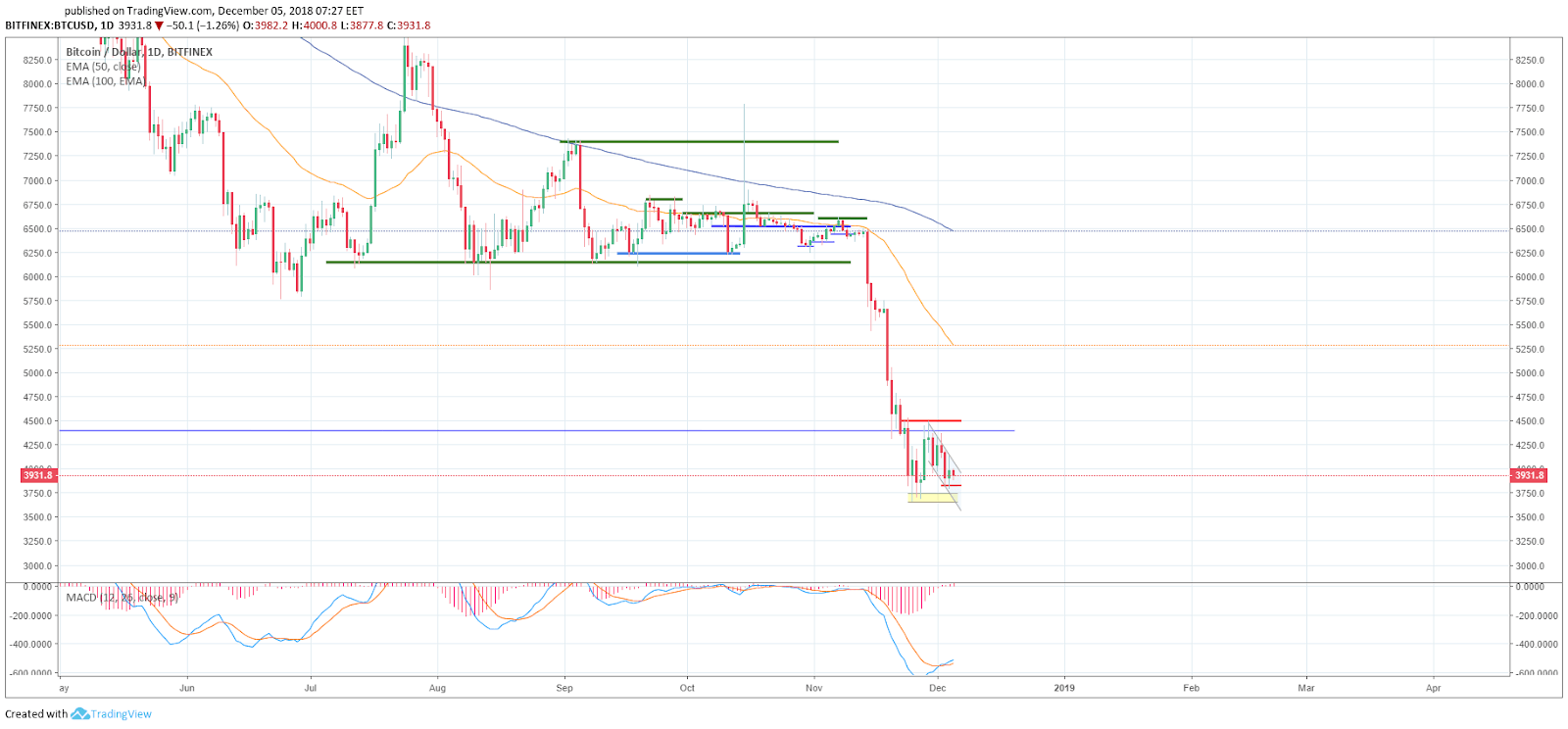

The daily timeframe captures well our current range $4,400$ — $3,750.

Given the BITCOIN current price, it is rather volatile. All indicators suggest the price continued slide. However, it very much looks like the market is already growing by long positions, that’s why buying at the levels close to the year minimum ($3,657) will bring a pretty good profit in the long run. But no one has abolished risks, of course.

The overall market meltdown has adversely affected not only the main cryptocurrency but other projects as well. Thus, the hash rate decline increased the cryptocurrencies vulnerability to 51 attacks that Vertcoin has already suffered. A series of attacks have, since mid-November, led to a loss of coins for over $100,000.

Moreover, a decline in the Bitcoin network’s hash rate has made Bitcoin mining more challenging. It has become the second major drop in the entire history.

The good news is that Nasdaq stock exchange will launch Bitcoin futures in the first half of 2019. The information was previously just rumors, but it has now been formally confirmed by a Nasdaq top manager.

It is not by chance that we started our review with a question and inflated expectations. For inflated expectations and fear of losing a profit result in rash acts in the market fraught with negative outcomes.

Friends, the market will not end tomorrow! Don’t hurry, especially if you have no trading skills and experience. We carefully analyse the price movement chart of the most popular cryptocurrency in order to shield you against loss-making transactions and we have succeeded in this, so far. The market is here to stay and it is quite realistic to make enough money in it to buy a Lamborghini.

P. S. The important thing is not to expect to make enough money for a Lambo within a couple of days and with a minimum deposit, for this would certainly be an inflated expectation.

Share this with your friends!

Be the first to comment

Please log in to comment