Hello! We are also experiencing such questions like «Well, when is growth coming already?» or «When will the Bitcoin cost $ 20,000?» quite often. Such inquiries reach us with enviable regularity, but we cannot...

Hello! We are also experiencing such questions like «Well, when is growth coming already?» or «When will the Bitcoin cost $ 20,000?» quite often. Such inquiries reach us with enviable regularity, but we cannot give a definite answer. We are not the fortune tellers, but we can clearly describe the current market state and provide you with a working and decent short-term forecasts. Today we have prepared an analysis of the cryptocurrency market on October 22.

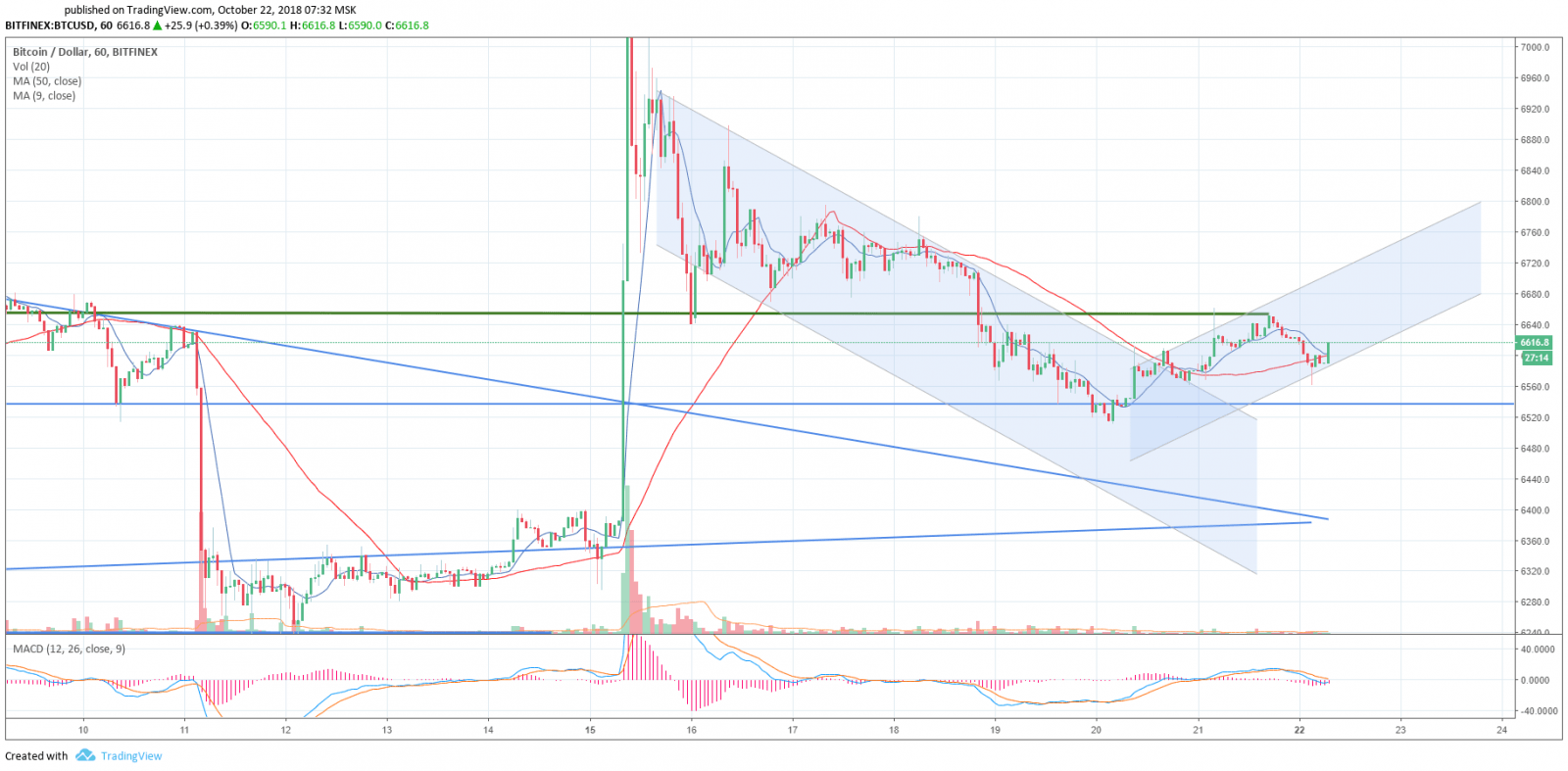

Considering the hourly timeframe

Having reached the support at $ 6,520, the price began to move in the uplink channel. Do note, that we defined this level in the latest review. We clearly see the range in which the price is clamped: $ 6,650 — $ 6,520. Fast MA9 is above MA50, and both are ready to turn up, and the MACD indicator, at the slightest upward movement, changes its direction and enters the buy area from the neutral area. For the upward movement, the price needs to overcome and consolidate above the border of the current range. Support for $ 6,520 is excellent in holding back the decline so far.

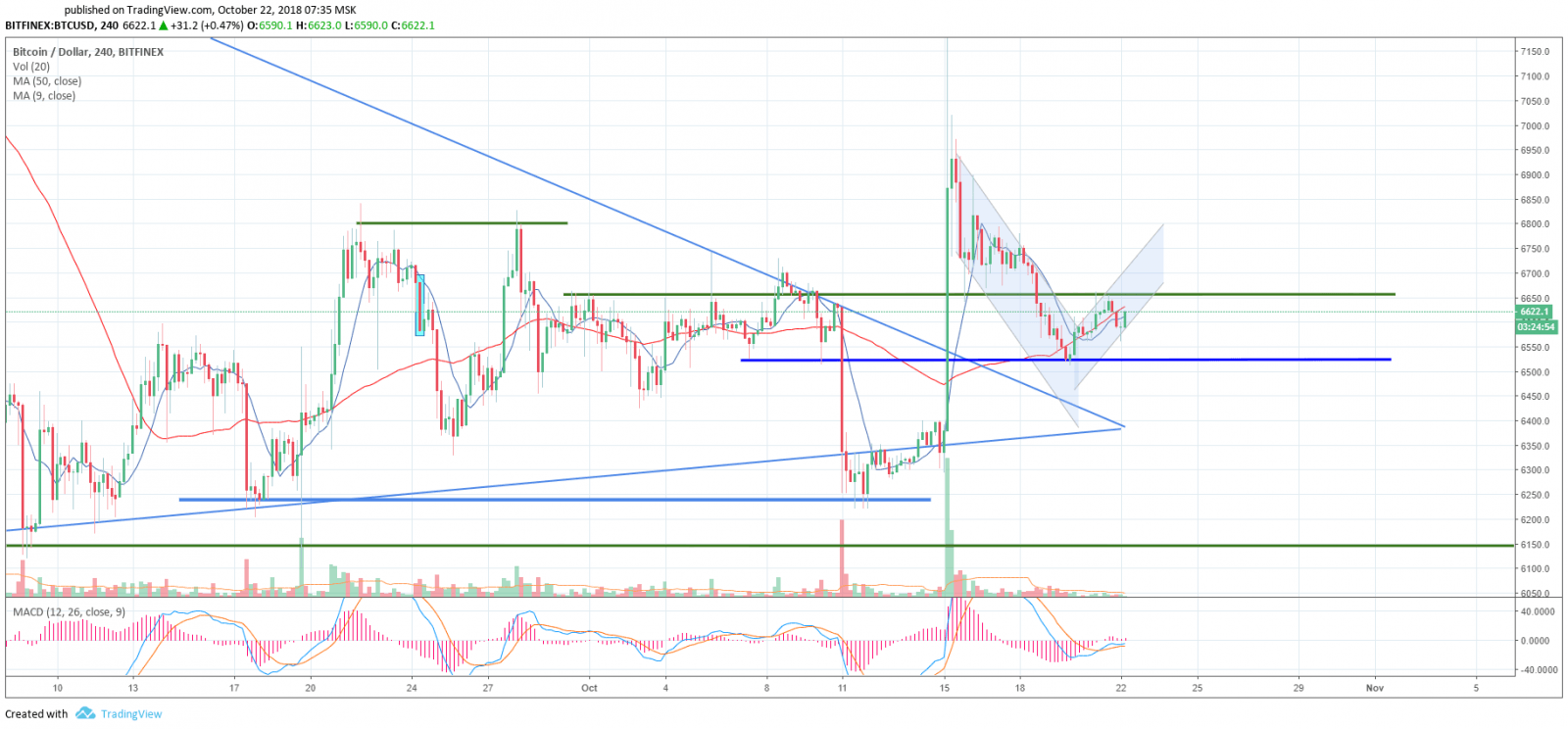

On the 4 hour timeframe the situation is similar

Everything is also strictly level by level here. The MA9 and MA50 sliding averages tend to go up and the fast can soon cross the slow from the bottom up, thereby forming a signal for an upward movement.

MACD is in the neutral area with a possible quick transition to the buy. In general, the market is ready for growth, but without flat volumes, and moreover — overall uncertainty may continue.

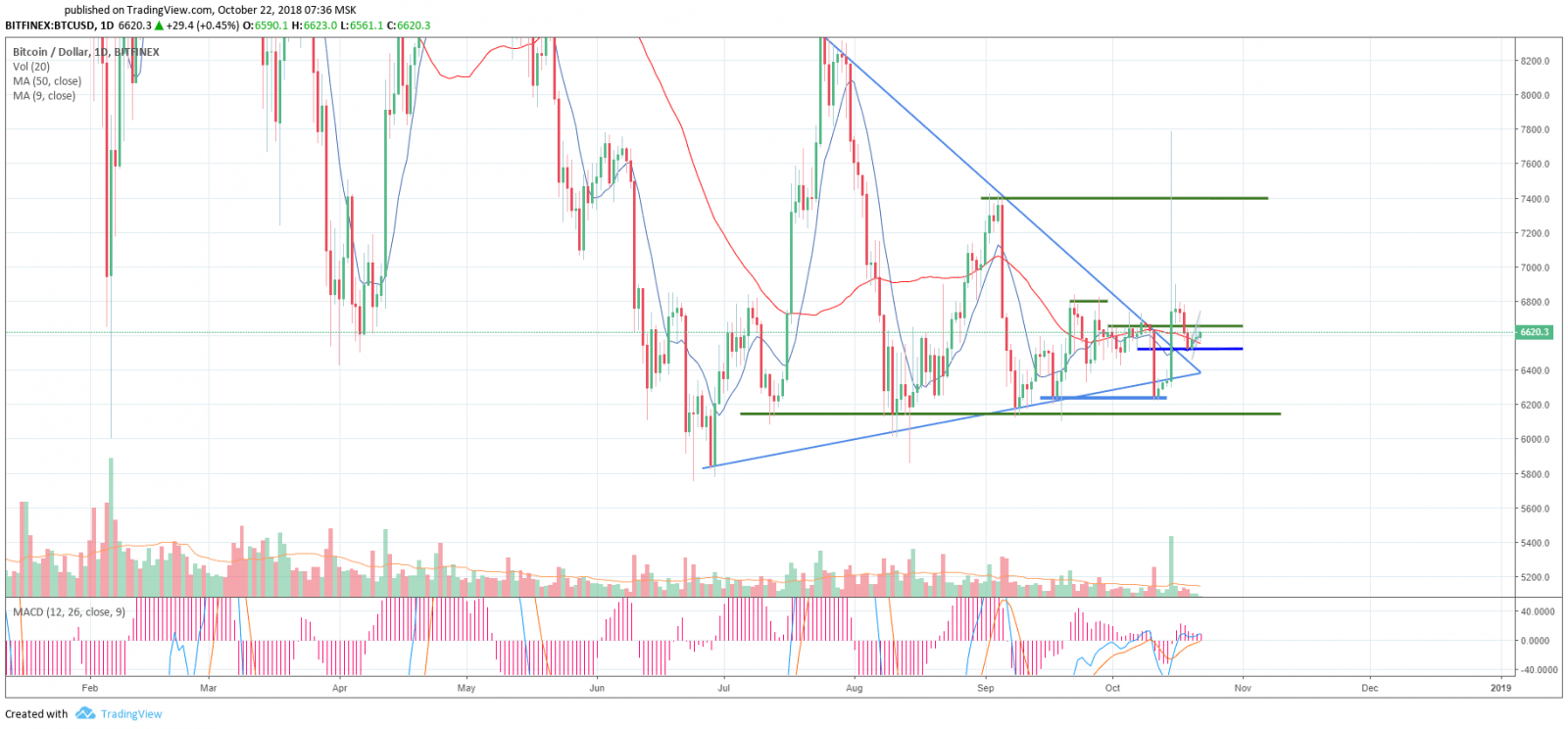

On the daily timeframe, fast MA9 crossed the slow MA50 from the bottom up — a signal to continue the upward movement. The MACD indicator, albeit sluggishly, but confidently shifts into the buy area. Support and resistance levels are clearly visible on the chart. Market capitalization remains at $ 209,482,761,817.

News that mattered last week

Last week, the market’s attention was focused on the story of the Tether stablecoin, which suddenly turned out to be not so stable. October 15, 2018, had become the black Monday for the USDT. However, on the background of the tokenized dollar fall, the demand for the Bitcoin has increased, and its growth in several exchanges followed the news. The details of this story we told in the last ovreview. However, the story with Tether is much longer than it might seem at first glance: Bitfinex is also tied to it, and the largest exchange has recently been accused of market manipulation. The American giant has already released a large read that has it all: Bitfinex’s clean reputation, trading with trading bots and the Rothschild conspiracy theory. Long story short — the Rothschilds are lobbying their IMMO stablecoin. The initiators of the investigation from Bitfinex found out that before the massive sale of USDT and the purchase of BTC, the USDT tokens were distributed to a number of wallets. The money came from several particular wallets, one of which was noticed in connection with the Rothschild project IMMO. Suspiciously that the same amount of money went to all the wallets — thanks to the blockchain we have an opportunity to notice such details. Vitalik Buterin and other crypto specialists, including Tim Draper, Lon Wong and Jimmy Song, have already debated Rothschild’s ties with the crypto world. However, for now, the situation unfolds in the framework of the classic FUD-news scenarios.

Bakkt platform announced to be launched soon. Bakkt will include federally regulated stock exchanges, custodial services (providing services for the storage and disposal of client’s property on the basis of his written order) services, applications for merchants and users. The platform will start to operate on December 12, at the start Bakkt will offer the market deliverable Bitcoin futures (unlike the settlement contracts for CBOE and CME, these tools are based on the possession of the real Bitcoin in account). The first contracts will be physically delivered against such currencies as USD, GBP and EUR. We have already written that the strength of Bakkt’s influence on the market can be compared with the introduction of Bitcoin-ETF or futures. The broad masses, including the institutionalists, will have a tool to enter the digital field seamlessly, and all this with the approval and adoption of a regulator, which still remains one’s fantasy.

The Ethereum Constantinople hardfork, initially scheduled for October or November of this year has been postponed. The problem is, particular bugs had been found in the tested update. We have covered the details about this situation in recent article. Moreover, read about the long-term prospects of the second-large cryptocurrency here.

The market is ready for the beginning of growth, but as we have repeatedly written before, without significant volumes and interest from substantial capital, the market will not have the forces to grow.

To fully understand our strategy, we recommend that you read our past reviews. We do not pursue the price, but we do work by levels, and we make it perfectly!

Everyone have a great week! We continue to monitor the market and provide you with operative and timely information!

Share this with your friends!

Be the first to comment

Please log in to comment