On Monday, we wrote about the resistance at the $4,200 level, which the bulls still could not overcome. The bears, in their turn, failed to bring down the price below $3,657 (the minimum from November 25,...

On Monday, we wrote about the resistance at the $4,200 level, which the bulls still could not overcome. The bears, in their turn, failed to bring down the price below $3,657 (the minimum from November 25, 2018) amidst the decline, at which bitcoin was bought quite well (we wrote about large purchases at those levels as well). Today, on November 28, the price is coming close to $4,200. Let’s look at the charts now.

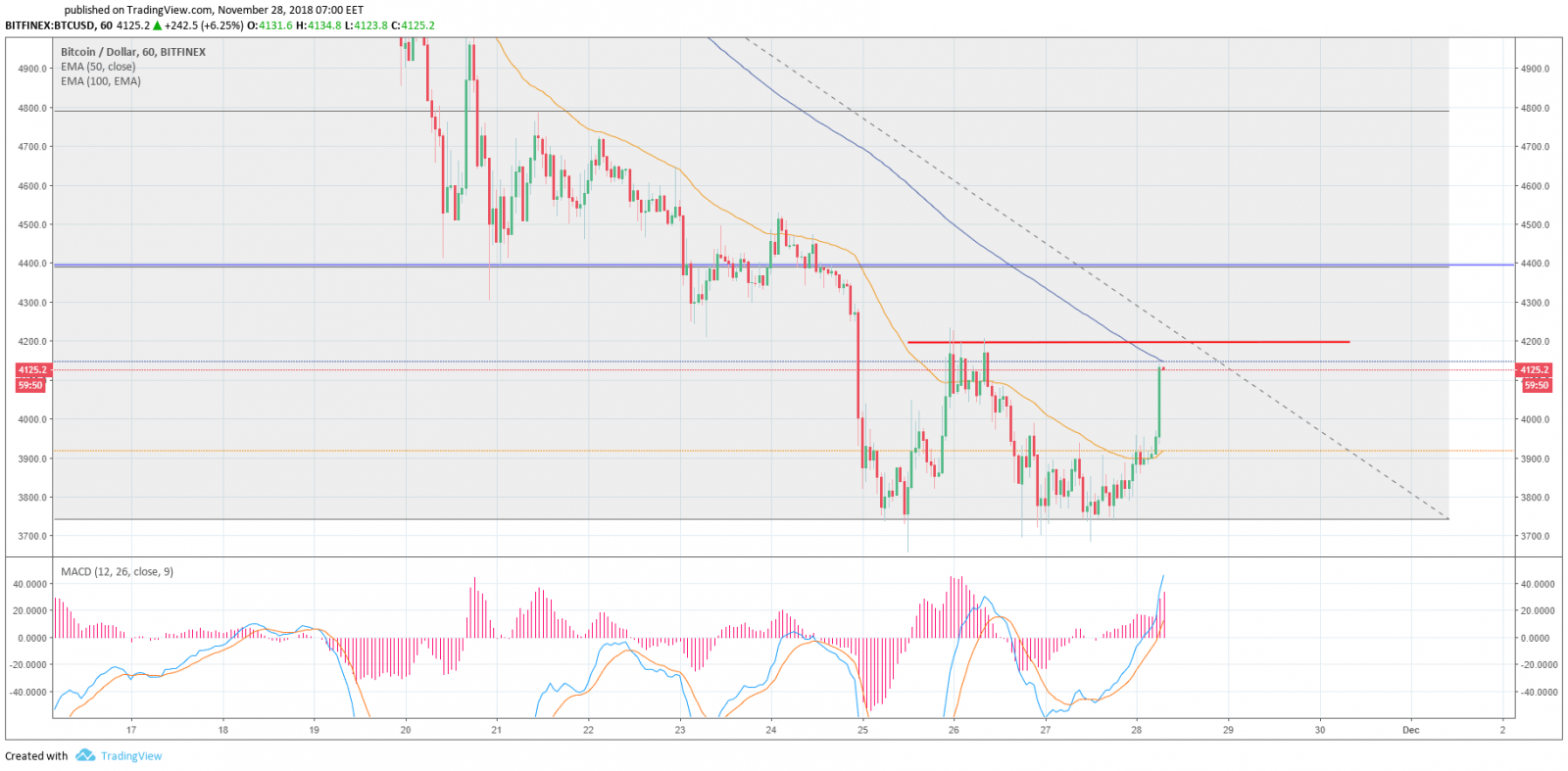

One-hour chart

The price is between EMA50 and EMA100 moving averages. ЕМА50 is below the price and it will provide support at the $3,920 level on the hourly chart. EMA100, in its turn, is acting as resistance at the $4,148 level (the price is at this level as of this writing).

It should be noted that EMA50 is turning upwards, and therefore, once it crosses EMA100 going from the bottom upwards, it will be an excellent signal for a continued upwards movement. The MACD indicator has left the selling are also signaling a strong bull run.

Attention should be paid to the $4,200 level. If the price fails to gain a foothold above it, we will follow up on the scenario described on Monday.

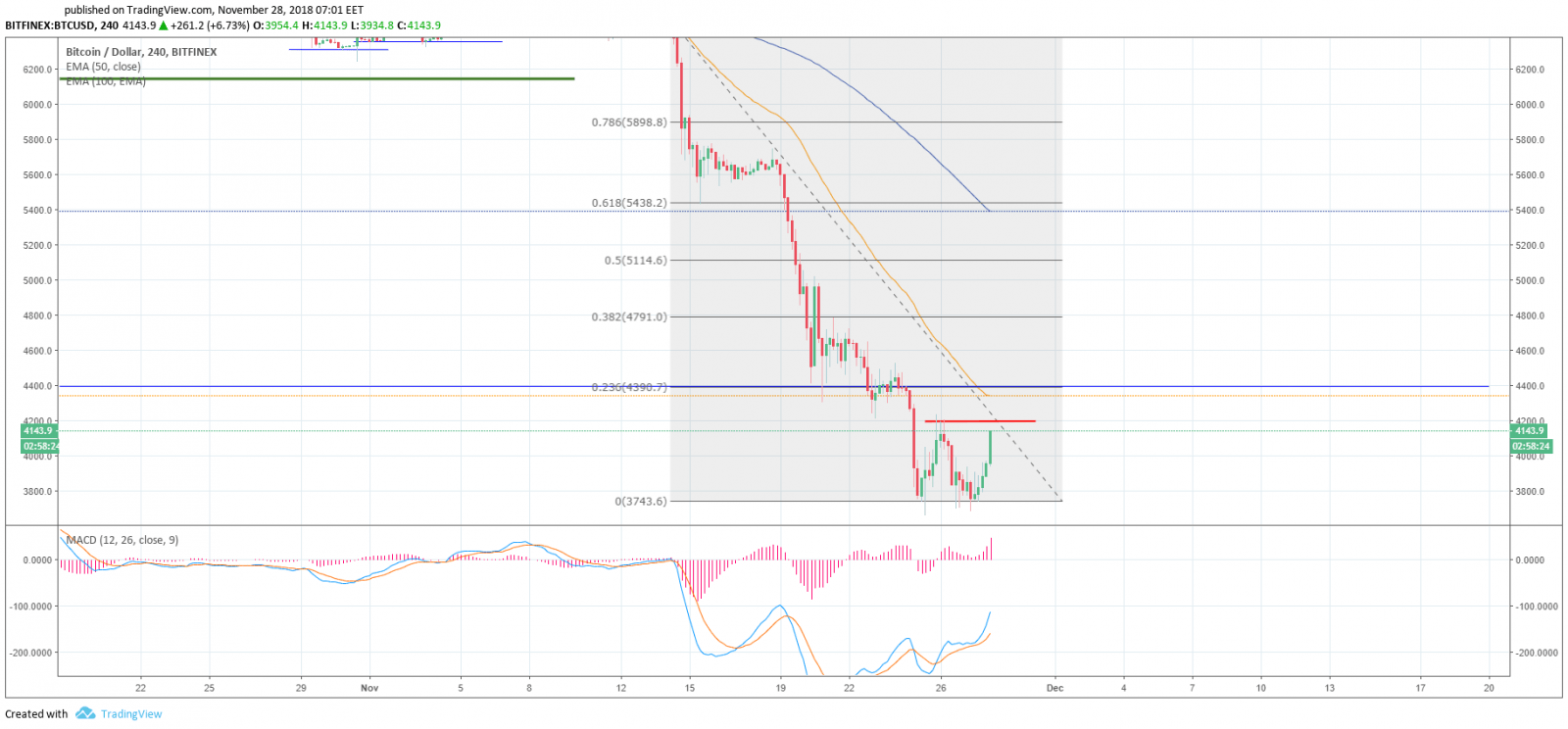

Four-hour chart

A «double bottom» pattern can be clearly seen on this timeframe. It is a reversal pattern. If the pattern is successfully completed, the bitcoin price is likely to come back to the $4,400 area and grow further.

Just like on the hourly timeframe, the $4,200 level offers a strong resistance. At the same time, moving averages are above the prices tending downwards. EMA50 is at the $4,340 level acting as local resistance. The MACD indicator is within the selling area trending upwards and thus preserving the growth potential.

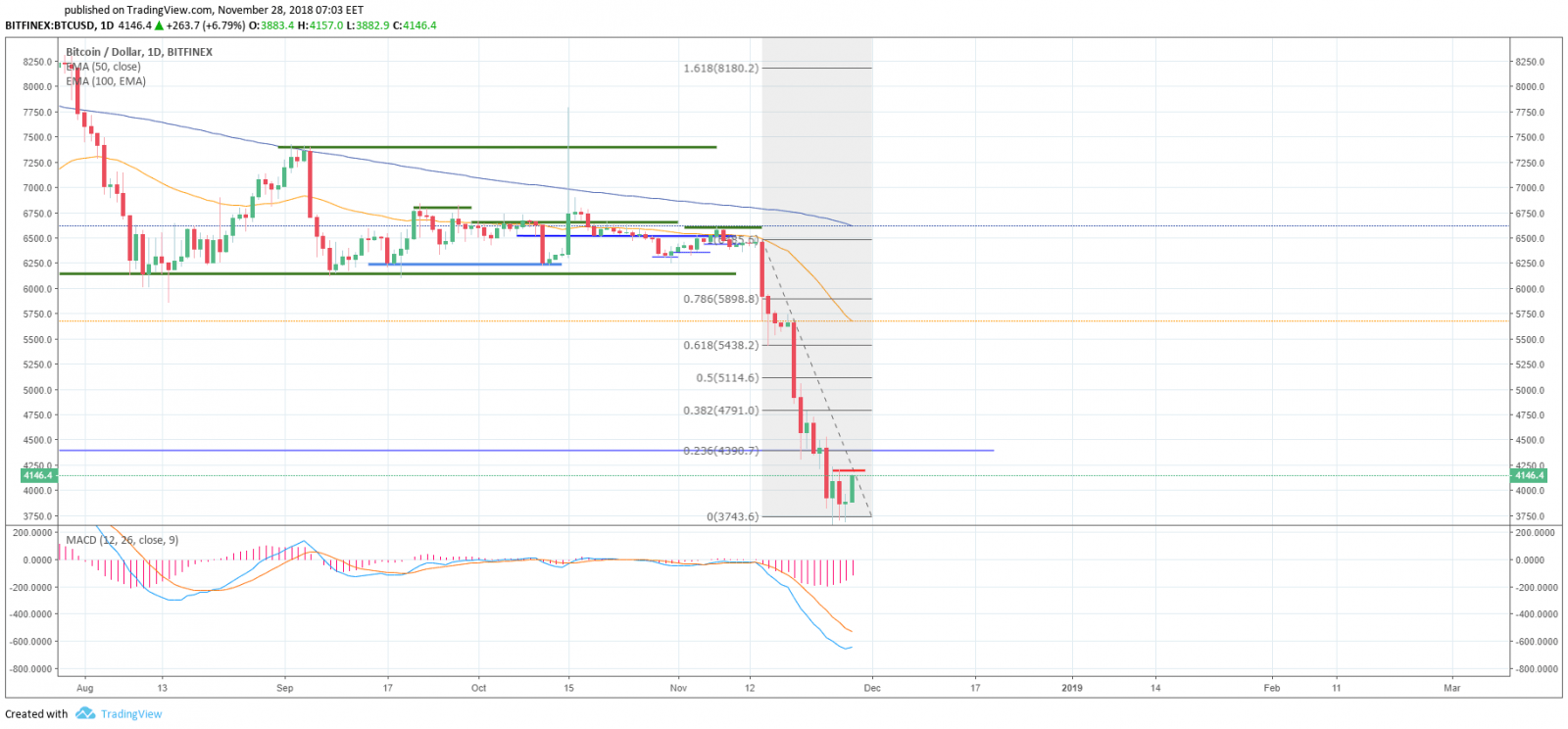

Daily chart

On the daily timeframe, the general trend remains downward. The MACD indicator is within the selling area showing signs of a reversal. The moving averages are above the prices tending downwards. This year’s lowest level of $3,657 acts as a support still managing to hold back the price decline. But the risk of a decline is persisting. Are you ready to buy BITCOIN, if its price goes down to the of $3,000 level?

Market capitalization has slightly increased to $132,650,388,964, but the general mood of the market remains negative. At the same time, large capitals owners do not see any reason for panic with the current decline, because Bitcoin lost its value on numerous occasions during its history.

In the meantime, two very important pieces of news were reported yesterday. The first one is that the United Arab Emirates is launching a new crypto exchange, where deposits can be made in the local currency. The new exchange in Dubai will offer a platform for trading crypto currencies, such as Bitcoin, Ethereum, Litecoin and Bcash.

«We will facilitate multiple payment options that include debit and credit cards, bank transfers. The funds will be deposited immediately in the user’s account», said Monark Modi, CEO, Bitex UAE.

The upshot is that while most mass media are «burying» the market, the UAE is launching a state-run cryptocurrency exchange.

The second piece of news is even more positive: SEC said that despite all the events that have been taking place, bitcoin ETF is definitely possible.

Surprisingly, this is not the last positive piece of news: Nasdaq, the world’s second largest stock exchange in terms of capitalization, is planning to launch bitcoin futures in the first quarter of 2019. Nasdaq’s contracts will be based on bitcoin spot price prevailing on numerous exchanges with information to be gathered by VanEck, a New York investment management company. Earlier, Nasdaq Exchange openly prepared for the launch of bitcoin futures in November last year. Some time before that, NYSE, the world’s largest stock exchange, announced that it would start trading its own Bitcoin contracts on the Bakkt platform on January 24, 2019.

At the moment, the recommendation for trading long-term is to buy with the decline to this year’s minimum and down to the $3,000 level, and if you do intraday trading, now is not the best time for entering the market.

P.S. Our editorial team are in no hurry to sell our BTCs ;) . Great profits to all of you!

Share this with your friends!

Be the first to comment

Please log in to comment