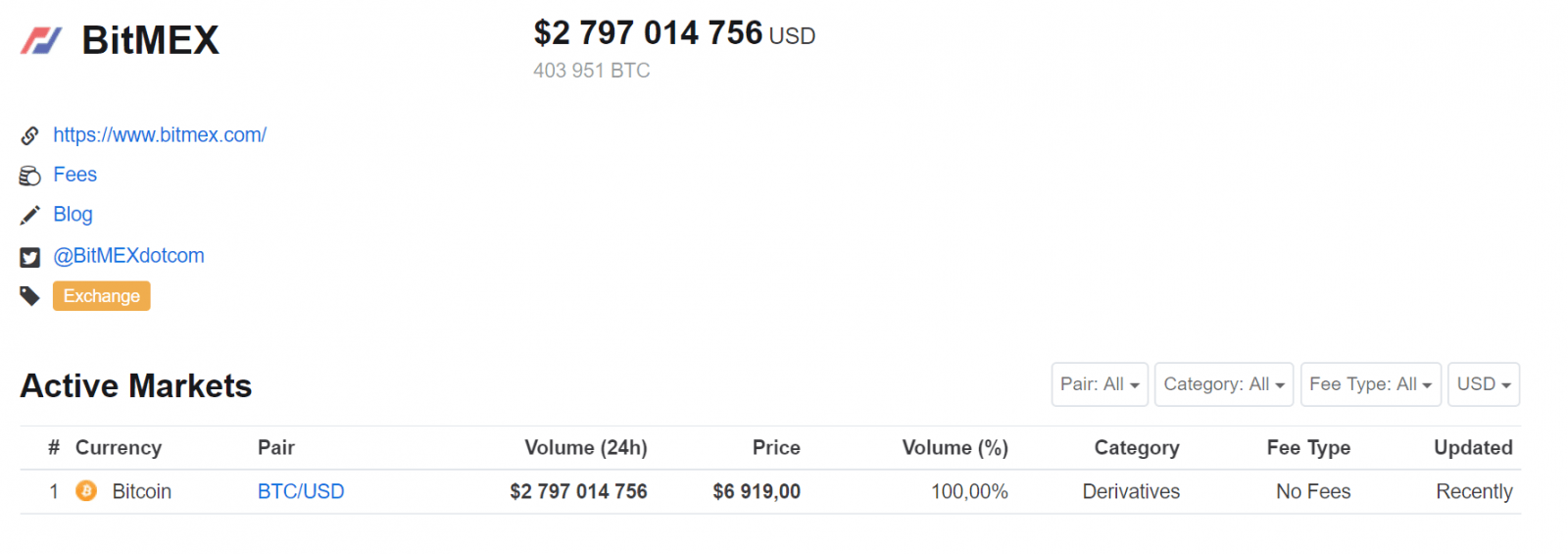

BitMEX is one of the largest crypto-currency exchanges based on the total volume of trades. The trading volume on it reaches billions of dollars per day. As of August 28th, 2018 the trading volume for...

BitMEX is one of the largest crypto-currency exchanges based on the total volume of trades. The trading volume on it reaches billions of dollars per day. As of August 28th, 2018 the trading volume for a 24 hour period was almost $3 billion.

Large volumes and, accordingly, high liquidity are the main advantages of the Bitmex exchange. This exchange attracts traders with large deposits because it also allows you to use leverage. BitMEX is perhaps the only exchange comparable to Forex in terms of leveraging: 1:100.

The BitMEX exchange is desirable since it is by no means a one-day event: the exchange was created back in 2013. Behind the exchange is a team of financial analysts from the United States. BitMEX is headquartered in Hong Kong. The legal name of the exchange is HDR Global Trading Limited and, as usual, this legal entity is registered in the Seychelles. The full name of the exchange is Bitcoin Mercantile Exchange. The following crypto-currencies are availableon the exchange: Bitcoin (XBT), Bitcoin Cash (BCH), Cardano (ADA), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Tron (TRX), and EOS (EOS).

How to register on BitMEX?

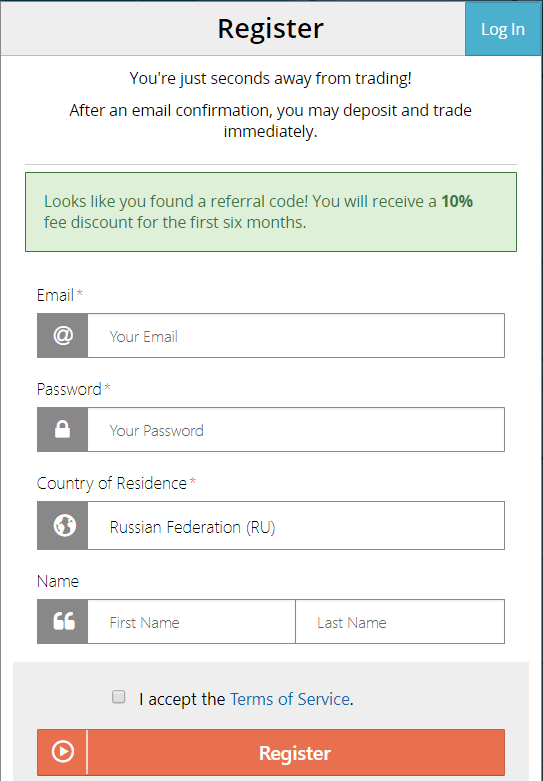

In order to register on the BitMEX exchange you need to go to the official site of BitMEX. The exchange supports English, Chinese, Russian, Japanese, and Korean. We select the Russian language and fill in all the fields in the opened registration window.

After you enter your details, you will receive a letter with a link to verify your e-mail address. You will need to follow the link from this letter.

How to deposit and withdraw funds on BitMEX?

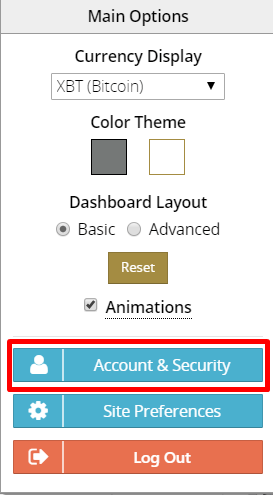

After confirming your registration you will be able to proceed to trading. But before that you will need to add to your account. Unfortunately, you can only add BTC to the account (which you must first purchase on the exchange). In order to find out the address to transfer BTC, you need to click on your login in the upper right corner and select «Account and Security».

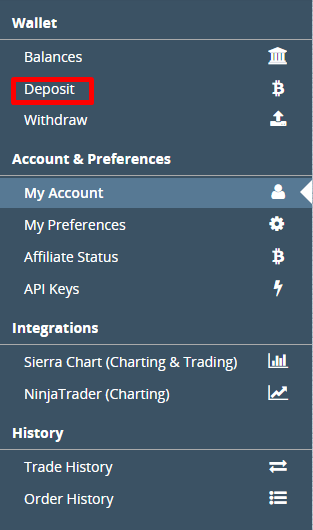

In the window that opens choose «Balance of funds» and select «Deposit» from the list on the left.

A page with a deposit address and a QR code will open. You will need to send BTC to this address. The deposit is credited after the first confirmation in the network. Once the funds are credited to the account, you can start trading.

How to trade on the BitMEX exchange?

In comparison with traditional crypto-exchanges, such as Binance or KuCoin, the BitMEX interface looks somewhat unusual. However, in general, it is quite intuitive. To begin with, it should be clarified that trading on the exchange does not take place with crypto-currencies, but with crypto-currency derivatives. American exchanges were the first to start trading derivatives of BTC.

Derivatives are derivative financial instruments (securities) that are based on the value of other assets. It comes from the English word derivatives, which translates as «derivative». Most often, derivatives are traded in over-the-counter markets. Crypto-currency derivatives are very attractive to institutional investors because they give the latter guarantees, unlike traditional trade in crypto-currencies. When trading derivatives, the trader transfers risk to a third party. According to statistics, the top 500 large companies that trade on exchanges, make transactions with the use of derivatives, rather than the assets themselves. The most famous derivatives include: swaps, futures, options, forwards. Many experts agree that the increase in crypto-currency derivatives is directly proportional to the amount of money coming in to the market.

So, back to trading on the BitMEX crypto-exchange. Since trading is done with the help of derivatives, in order to buy Bitcoin for $6,000 you need to purchase 6,000 XBT/USD contracts. In case you want to short the asset, you need to sell the same number of contracts. If you use a leverage of 1:10, then you need to purchase 600 contracts to get that profit.

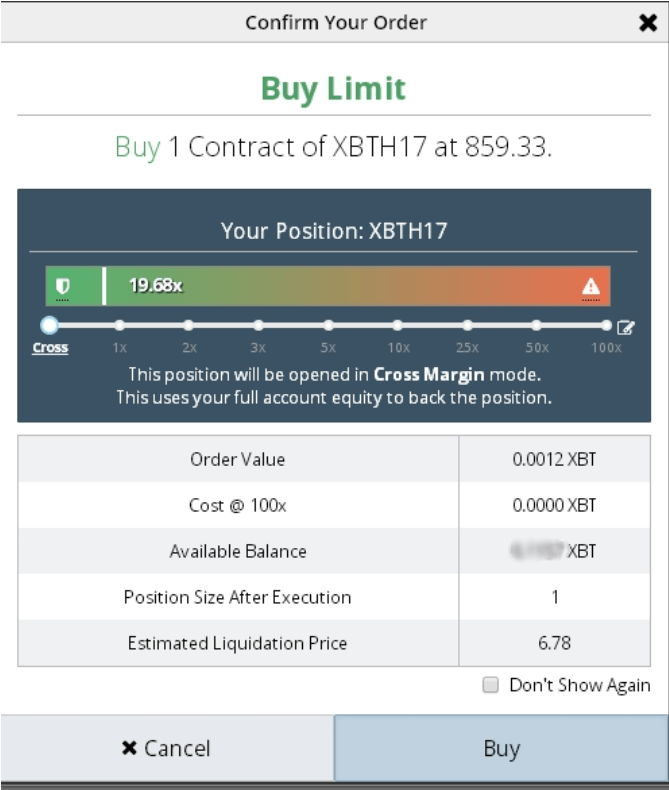

After selecting a trading pair, you need to go to the purchase window. The purchase window can be set to choose from several types of orders: limit or market. In addition, the exchange offers a stop limit order, stop market order, trailing stop order, take profit limit order, and take profit market order. Using «limit» it is possible to order the purchase of a crypto currency at the desired price, at the market price, or buy the crypto-currency right now. The number of contracts you want to purchase is indicated in the column «Quantity». After you place the order, a window will appear where you will have to confirm the transaction:

Leverage on the BitMEX exchange

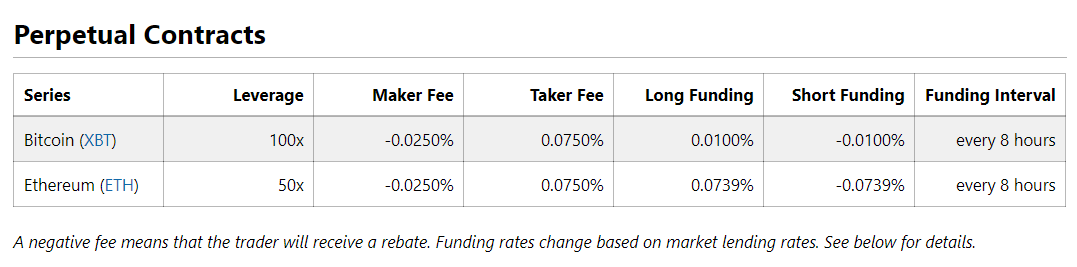

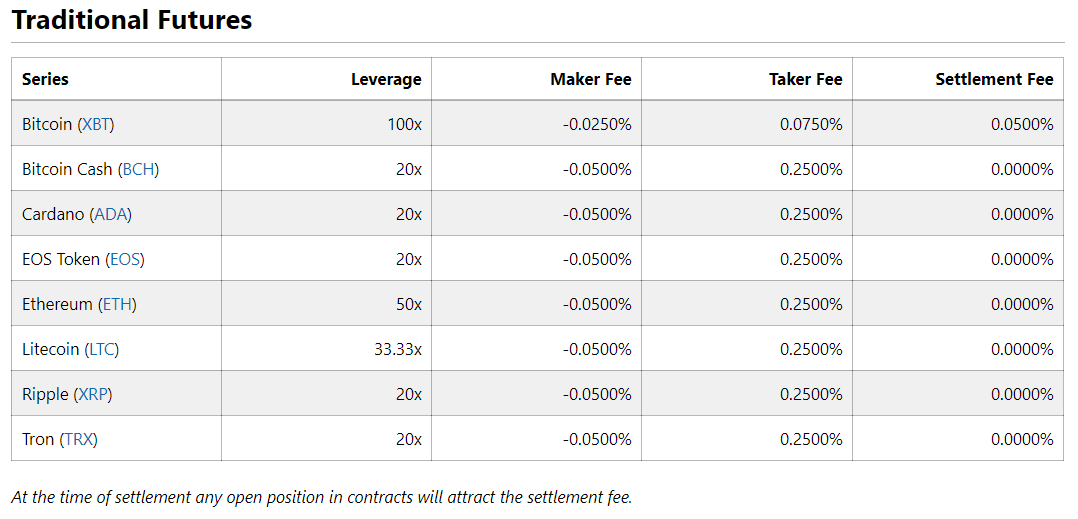

The maker pays the one who places the order. The taker is the one who buys a limit order.

Leverage on the BitMEX exchange

Margin trading is borrowing money from a broker. The principle of margin trading is to enter into transactions not only on your deposit, but also to use borrowed funds. Marginal trading is a highly profitable, but also a risky trade. The maximum size of a leverage trade on BitMEX is paired with BTC at 100:1, with other alt-coins at 25:1. Trading with leverage should only be used if you are 100% sure of your forecast. If the rate goes the other way, a «Margin Call» will occur — the position will be liquidated with the loss of funds in the trader’s account. So, having on account 0.2 BTC at the current Bitcoin rate you can buy 200 contracts with $10,000. With a leverage of 5x you can buy 1,000 contracts, respectively.

In the column «Estimated price of liquidation», or estimated liquidation price, the price is indicated, upon which the order will be automatically closed.

Basic concepts of margin trading:

- Long, or a long position — a bet on the price increasing.

- Short, or a short position — a bet on the price reducing.

- Liq. price, or liquidation price — the price level at which the position is reset to zero and the trader loses money.

- Leverage — the coefficient by which the trader’s rate is multiplied.

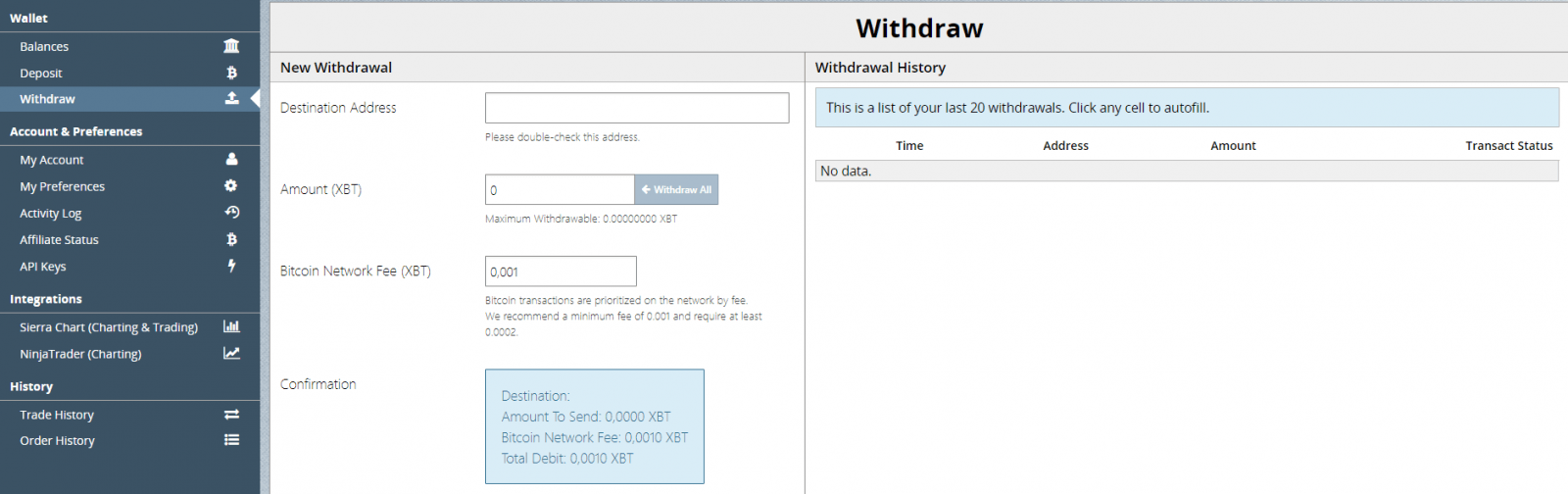

How to withdraw money from the BitMEX exchange

You can withdraw money from BitMEX only in Bitcoin. To order a BTC withdrawal, you need to go to the Account tab and select the «withdraw funds» section. In the column «Destination address» write the address of the Bitcoin wallet, enter the required amount, pay a commission, and order the transfer.

All inquiries are manually handled by the employees of the exchange, which is an additional guarantee of security. For the request to be processed the same day, it must be sent before 13:00 UTC.

Summary

Summing up, we will highlight the advantages and disadvantages of the exchange. Pros:

- a high level of security;

- availability of several languages, as well as a fairly high-quality translation into Russian;

- relatively low commission fees;

- the opportunity to work with an exchange without verification;

- the largest leverage among crypto-instruments is x100;

- convenient and thoughtful interface;

- high liquidity;

- the opportunity to open short positions and earn on the fall of the rate.

Among the shortcomings can be identified a small selection of assets, as well as the inability to replenish the account in another crypto currency, except BTC.

The BitMEX exchange is slightly different from its competitors in that it does not try to attract users with various advertising campaigns and beautiful slogans. The site is more focused on self-confident professionals who value reliability and quality.

Share this with your friends!

Be the first to comment

Please log in to comment